Supreme Court strikes down Trump’s tariff plan

In a 6-3 vote, the conservative-led High Court disputed Trump’s argument that a 1970s law gave him the power to impose tariffs

The Supreme Court struck down President Donald Trump’s sweeping tariff agenda Friday, dealing a seismic blow to the president’s key economic policy after months of chaos with America’s trading partners.

A ruling from the nation’s conservative-majority high court determined that the president’s global levies were unlawfully imposed under the 1977 law, the International Emergency Economic Powers Act.

“The president asserts the extraordinary power to unilaterally impose tariffs of unlimited amount, duration, and scope. In light of the breadth, history, and constitutional context of that asserted authority, he must identify clear congressional authorization to exercise it,” Chief Justice John Roberts wrote in a 6-3 decision.

Conservative Justices Neil Gorsuch and Amy Coney Barrett, both appointed by Trump, joined Roberts as well as liberal Justices Sonia Sotomayor, Elena Kagan and Ketanji Brown Jackson in ruling against the president.

The president called the ruling a “disgrace” in the immediate aftermath, The Independent understands.

The decision is likely to have a significant economic impact. The administration had warned that such a ruling could force them to refund billions of dollars in revenue collected from the tariffs.

Justices Clarence Thomas, Samuel Alito and Brett Kavanaugh dissented, raising concerns about the refund “mess” that could arise.

“The interim effects of the Court’s decision could be substantial. The United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs, even though some importers may have already passed on costs to consumers or others,” Kavnaugh wrote in his dissent.

The court did not offer clear guidance about the refund process moving forward. But companies that had to pay tariffs may be able to seek a refund from the Treasury Department.

The Trump administration has suggested it has potential workarounds that could keep similar levies in place. However, it’s unclear how quickly they could do so before being required to issue refunds.

Friday’s decision will not impact all of Trump’s tariffs, just those brought under the 1970s law. That includes “reciprocal” tariffs on other countries and tariffs specifically imposed on Canada, China and Mexico to stop the flow of fentanyl.

Tariffs imposed on specific sectors, such as aluminum or steel, can remain in place.

Democratic lawmakers celebrated the Supreme Court’s ruling with California Governor Gavin Newsom taunting Trump to “pay the piper.”

“Time to pay the piper, Donald. These tariffs were nothing more than an illegal cash grab that drove up prices and hurt working families, so you could wreck longstanding alliances and extort them,” Newsome said in a statement. “Every dollar unlawfully taken must be refunded immediately — with interest. Cough up!”

Senator Amy Klobuchar said: “With today’s decision, it is clear that Congress – not the president – has the power to impose tariffs. We must reassert this authority and stand up for American workers, businesses, and consumers.”

Even some Republicans joined the celebration.

Former Vice President Mike Pence said: “In Learning Resources, Inc. v. Trump, our Supreme Court has reaffirmed that the Constitution grants Congress - not the President - the power to tax. American families and American businesses pay American tariffs - not foreign countries. With this decision, American families and businesses can breathe a sigh of relief.”

Senator Rand Paul, a consistent critic of Trump’s, praised the court for making “plain what should have been obvious: ‘The power to impose tariffs is “very clearly a branch of the power to tax.’”

Senator John Curtis said: Today’s ruling affirms, despite all the noise of the moment, that the Founders' system of checks and balances remains strong nearly 250 years later. Several questions remain unanswered, including what happens to the revenue already collected and how the Administration may use alternative authorities to impose tariffs. Looking ahead, it is critical that we provide the clarity and predictability businesses need.

Justices were asked to determine whether Trump was authorized to impose sweeping tariffs on nearly every one of the nation’s trading partners under the 1977 International Emergency Economic Powers Act, which permits the president to regulate trade in “unusual and extraordinary” circumstances when a national emergency is declared.

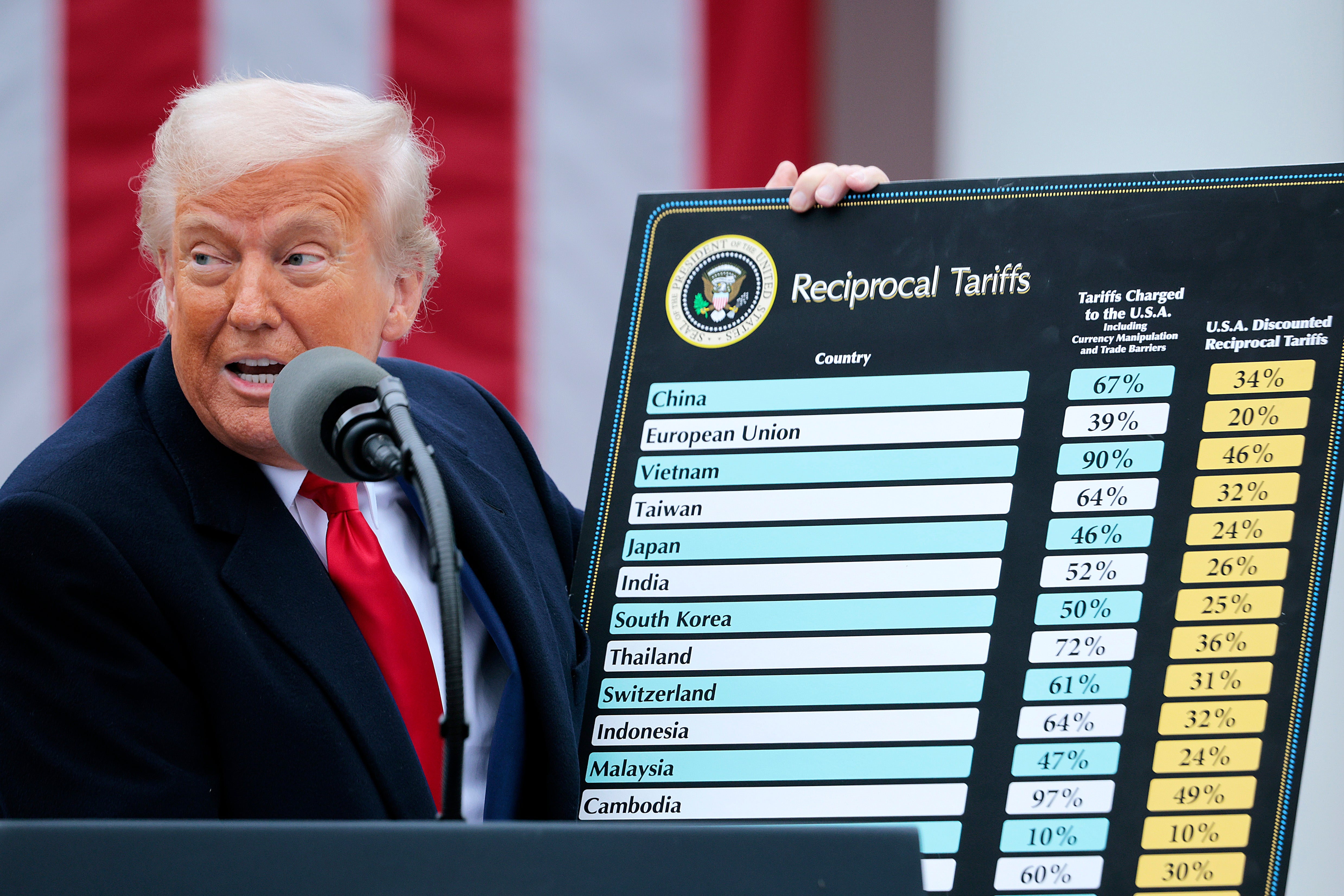

Trump invoked the act when he decided to impose a baseline 10 percent tariff on most countries, in addition to heavier “reciprocal tariffs” on “Liberation Day” in April. The president argued the tariffs were a matter of national security because it was necessary to balance trade deficits.

The result: a global stock market crash and multiple lawsuits from small businesses that said the tariffs negatively impacted their ability to operate and were unfairly brought under the emergency act. Trump repeatedly walked back the tariffs and the markets rebounded.

Two lower courts, including the U.S. Court of International Trade, sided with the businesses that sued the administration, saying the president had overstepped his authority when declaring a national emergency.

Justices appeared skeptical of Trump’s argument during the Supreme Court’s oral arguments November 5.

Roberts, who has steered the court to expand the president’s executive authority, explicitly stated that tariffs, even when used for foreign affairs, are considered “taxes on Americans” — a power that belongs to Congress.

Barrett questioned why some of the country’s closest allies, such as Spain and France, would need to be tariffed due to “threats to the defense.”

At the same time, justices also expressed caution, noting that a ruling against Trump could force the U.S. to return billions of dollars in tariff revenue, resulting in an economic recession.

For months, Trump had been urging the justice to uphold his sweeping tariffs, making grandiose statements, such as suggesting the case was “life or death,” claiming a negative decision posed the “biggest threat” to national security and warning of “economic disaster.”

Both Commerce Secretary Howard Lutnick and White House trade adviser Peter Navarro have said the administration has been preparing a “plan B” to continue levying taxes on broad swaths of imports using more traditional authorities available to the president under existing trade law.

Alex Woodward and Andrew Feinberg contributed to this story.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks