The Epstein files have revealed a dark truth about rich people and the twisted games they play with money

As the wife of a banker, Helen Kirwan-Taylor has seen the smoke and mirrors used in the lifestyles of the privileged elite. It is no surprise that the likes of Sarah Ferguson and Peter Mandelson turned to figures such as Jeffrey Epstein for loans – the rich often only manage to stay afloat through a series of complex borrowing strategies known as ‘Buy, Borrow, Die’

Jeffrey Epstein’s seedy life has now been blown wide open. Aside from the depravity, what has also been exposed in those millions of files is the inner workings of the rich and powerful he serviced. Fame is constantly examined in tabloids, but wealth has always been harder to ascertain thanks to complex and secretive banking, legal and accounting practices. No one can dispute “celebrity” because we, the public, helped make it happen (by watching the movie, downloading the music, buying the products). Wealth is a magic trick: it is what we think it is.

Between all the grim lines in the Epstein files are illustrations of just how much wealth is about a series of backroom deals and shady business practices. The begging bowls that so many of Epstein’s acquaintances came holding are laid out clearly within the thousands of emails (which came with the mistaken confidence of anonymity). People we might have associated with great privilege and access to wealth, thanks to connections, turn out to be the most basic of grifters, including Ghislaine Maxwell herself.

Top of the Epstein list is Fergie, Duchess of Kent, who in 1990 was £4m in debt thanks to dodgy deals (and Fake Sheikh debacles) as well as extravagant habits like spending $25k at Bloomingdale’s in one hour. Epstein, it turns out, was her private banker/credit lender/financial adviser-cum-Svengali.

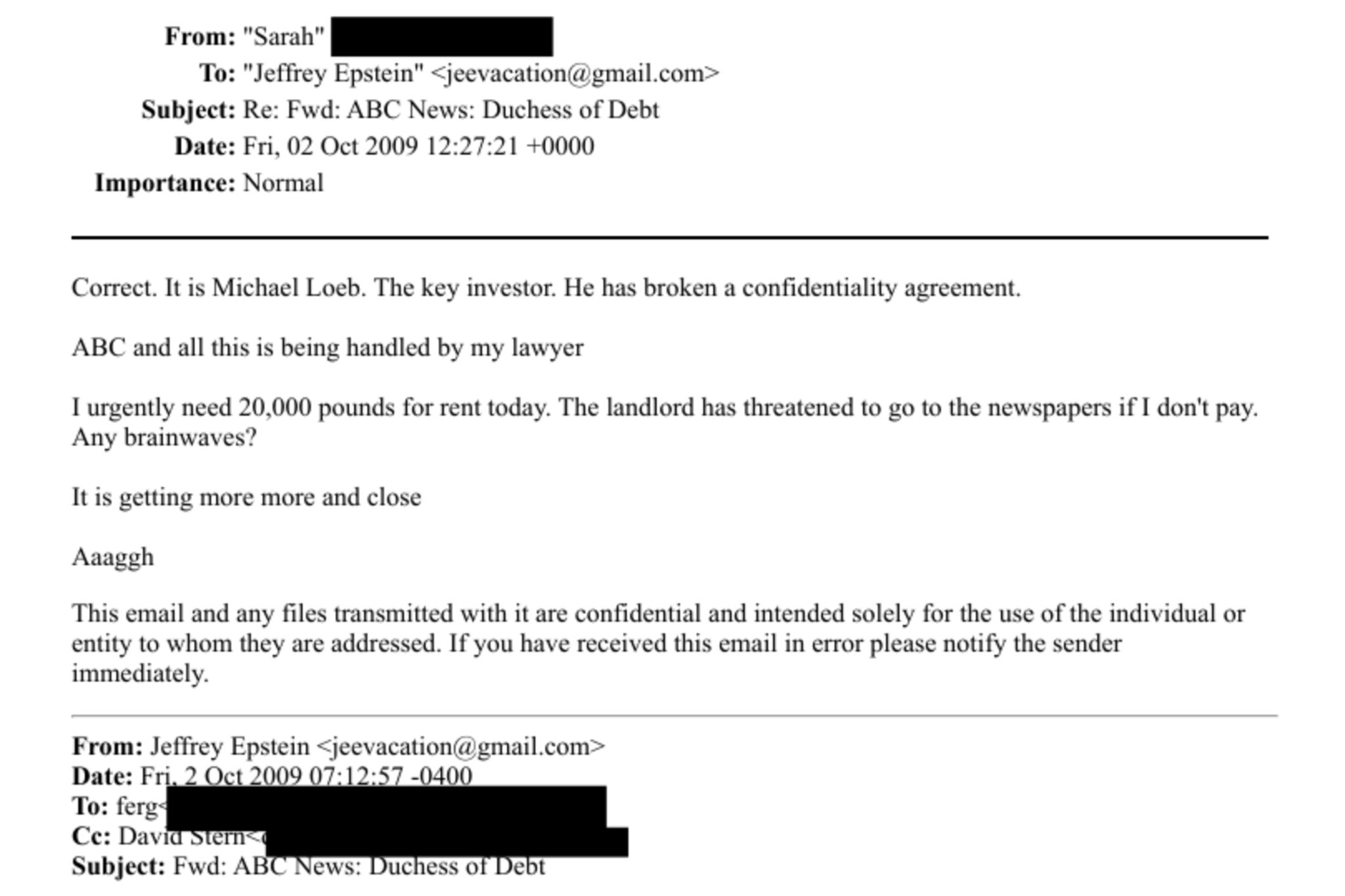

As early as 2009, we see Fergie begging Epstein: “I urgently need 20,000 pounds for rent today,” she wrote. “The landlord has threatened to go to the newspapers if I don’t pay. Any brainwaves?” In March 2011, she accepted another £15,000 loan to pay back a member of staff. Epstein also acted as her stockbroker, facilitating some share transactions, presumably as further leverage.

Then we have someone who, by all accounts, had the means, access and brains to make and manage money on his own – Peter Mandelson. Documents recently released show that the Labour peer also begged for money and Epstein obliged, sending him £75k and his then partner (now husband), Reinaldo Avila da Silva, £10k for an osteopathy course (which the General Osteopathic Council says he never completed). The sums are minuscule given the financial circles Mandelson ran in, which begs further questioning: what else did he hope to gain materially from this friendship?

Now we know Mandelson was also forwarding confidential government information to the disgraced financier. Epstein, it seems, gave grifters and wannabes with useful contacts a hope of joining the wealthy circles he serviced, many of whose fortunes seem to have been built on stilts. A case in point is the scheme mentioned in emails for Mandelson to purchase a £2m apartment in Rio, via a Panama shell company, for tax avoidance purposes. If he needed to borrow £75k, then where would that £2m have come from? Would Epstein have lent him this amount, and in return for what currency of favour?

What all these documents expose is the cloak-and-dagger world of high finance and wealth. What many people don’t understand is that wealth is often a game of appearances, an often hollow one predicated on all kinds of things, including extensive borrowing. So many toys – cars, yachts, properties, jewels – are available to lease (or even rent by the hour for an Instagram picture), so if you want to give the illusion of being rich, it’s not all that difficult. If you don’t lease or rent your luxuries, you can always steal, as in the case of the debt-ridden socialite entrepreneur David Tang, who transferred funds from his company to his private account to fund his lifestyle.

As the wife of a banker, I have seen acquaintances use their own banks as “generous” mortgage providers to live way above their means or (taxable) bonuses. Houses, cars, holidays, parties, even generous donations to charities, it turns out, were paid for by debt (the donations made in public never arrived, of course). A friend, now divorced from a senior banker, woke up one morning to find the Notting Hill and Oxfordshire houses she called “home” did not actually belong to her or even him, for that matter. Not only was the family’s lifestyle entirely “borrowed”, but the seven-digit bonuses he received that she believed to have been wisely invested had all been spent, and the taxes never paid.

The closer the proximity to financial institutions, the easier it is to juggle debt. A property tycoon we know once explained that he had the most enormous life insurance policy that money can buy because almost all of his holdings are in debt, including his primary residence, which is now rented out. When the markets were good, he was worth millions of millions (on paper, of course). Some people we know have borrowed to maintain the lifestyle of the circles they move in (who exclude those who can’t keep up): this, more than anything, is the seed of destruction.

Billionaires often carry the most debt. We all know, thanks to the IRS leaks, that Donald Trump’s entire empire has been predicated on losses (the documents confirmed that Mr Trump paid no federal taxes in 2020 and only $750 (£622) in 2016 and 2017. He paid close to $1m in 2018). Bankruptcy does normal businessmen in; however, Trump continued to get loans.

“He’s the quintessential businessman and he’s got his hands in everything,” says Maryann Monforte, a professor of accounting practices at Syracuse University. “He started out in real estate, and that creates a level of complexity between valuations, revenues, losses and depreciation. That all means his return has an added layer of complexity that you might not see with other billionaires.”

Actually, you do. In every billionaire’s household is a private office that employs fancy lawyers and accountants, whose sole job it is to keep all the planes in the air through complex borrowing strategies called “Buy, Borrow, Die”. The gist of this is never to spend capital or profits but to constantly borrow against them in such a way as to maximise growth and minimise tax.

This is where private banks and specialist lenders come in. A securities-backed line of credit is offered against your appreciating assets (stocks, property, art), which become your collateral. These preferential loans (based on having substantial deposits or investments) often come with lower interest rates (5 per cent interest compared to 10 per cent growth on a stock portfolio). Instead of selling shares and accruing capital gains tax to buy, say, another plane, the rich use a loan, which is not considered taxable income (using investments and art for collateral is called Lombard lending). When a loan is due, the very rich simply take out another loan against that one and so on. How they sleep at night is another story.

This is all done through expensive specialists involving offshore structures, trusts and what is called Special Purpose Vehicles, schemes Epstein was paid enormous amounts to deliver (the main reason so many wannabes flocked to him). Meanwhile, their portfolios continue to grow. The “Die” provision of the tax code (in America) means the cost basis of these assets is stepped up to their current value, effectively eliminating capital gains tax for heirs.

Of course, when markets turn sour, the same people living it high in St Barts on yachts, paid for by loans, find themselves on the wrong side of the markets. I suspect many of Epstein’s clients turned to him at this point because any reputable financial house would have flat out rejected them.

For the grifters, Epstein held out hope that if they just did as he asked, these simple optical wealth illusion tricks could be theirs too.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks