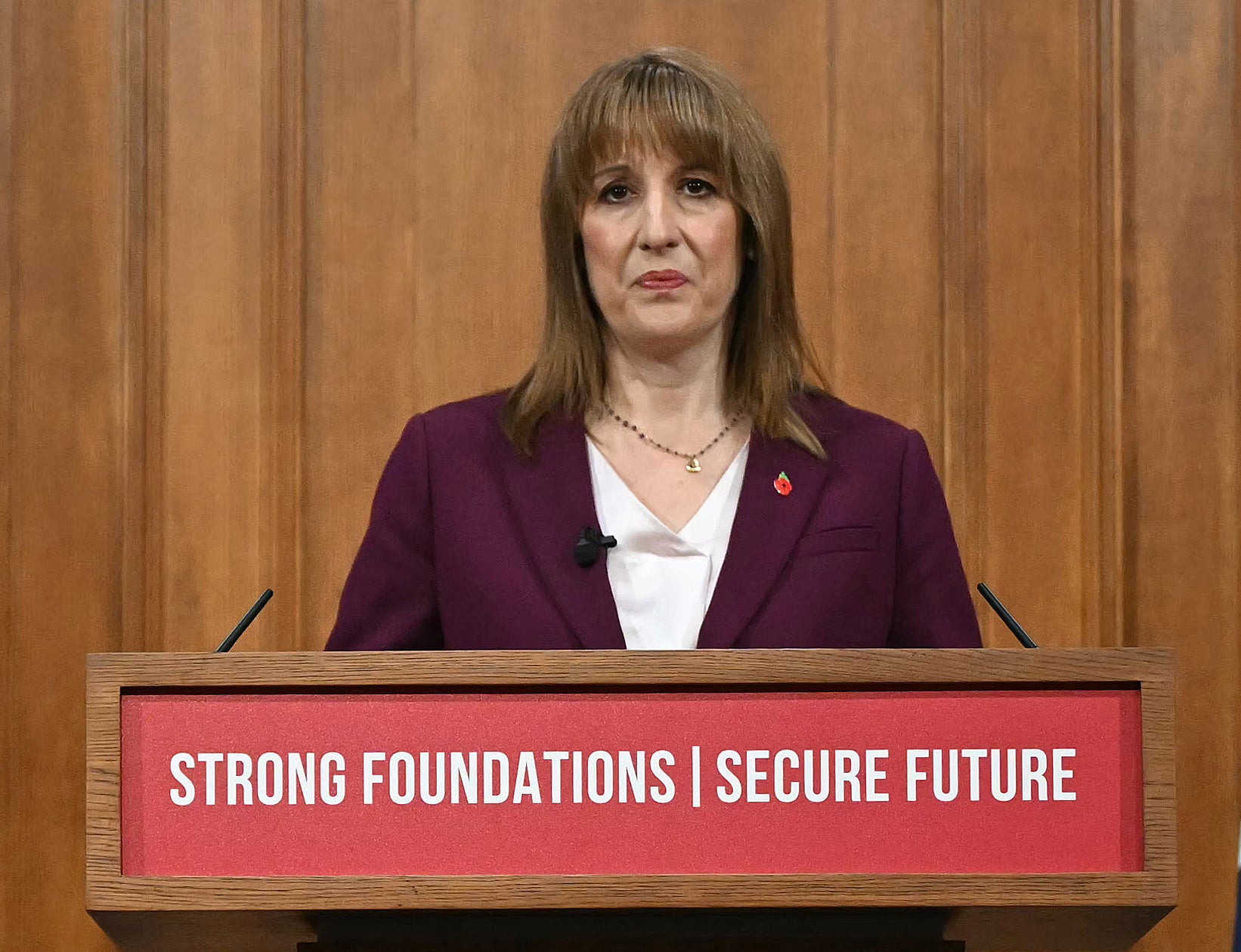

Rachel Reeves to ditch plan to raise income tax in Budget

Chancellor set to abandon income tax hike plan amid fears move could anger voters

Rachel Reeves has abandoned plans to break Labour’s manifesto pledge and raise income tax at this month’s Budget.

The chancellor had seemed to lay the groundwork for a controversial hike income tax in an attempt to fill the hole in the public finances, warning earlier this week that keeping to the manifesto would signal “deep cuts” to public investment.

But the Financial Times has reported that she has now abandoned those plans over fears they could anger both voters and backbench Labour MPs.

The cost of long-term borrowing spiked on Friday morning in the wake of the speculation, with 10-year gilts up 12 basis points at 4.56 per cent.

The chancellor could now be expected to make changes to lots of smaller taxes in an attempt to fill the UK’s coffers, a move that she has been warned could make the system “more complicated and inefficient”.

Culture secretary Lisa Nandy said on Friday morning that ministers are working on “making the fairest possible choices”.

Speaking to Times Radio, she described Budgets as “the subject of a lot of work and careful consideration and, in our case as a government, about making the fairest possible choices so that we can help the economy to grow, and we can also ease the pain that people have been put through over the last decade-and-a-half”.

She said that “concrete details” will be set out on 26 November and pledged that ministers will “make sure that those with the broadest shoulders bear the greatest burden”.

She also told Sky News that the chancellor has “never been shy of facing people down” to do what is best for the country.

A Treasury spokesperson said on Friday: “We do not comment on speculation around changes to tax outside of fiscal events. The chancellor will deliver a Budget that takes the fair choices to build strong foundations to secure Britain's future."

But there was fury from Labour MPs.

The speculation comes at the end of a turbulent week, after a series of briefings on potential threats to the PM which have left Starmer’s position more precarious.

One Labour MP told the Independent: “I don't think they have a clue. They're making even good news look bad.”

Any decision not to increase income tax means that a raft of smaller interventions are on the table, thought to include a gambling tax and a mansion tax on properties valued over £2million.

Stephen Millard, deputy director of the National Institute of Economic and Social Research (NIESR) told The Independent: “There are two dangers here. First, by resorting to smaller changes to lots of marginal taxes, the chancellor risks making the overall tax system ever more complicated and inefficient (in the sense of creating more distortions in the economy).

“Second, this would make it harder for the chancellor to build a large buffer against her fiscal rules. As we’ve seen over the past year, having a small buffer creates uncertainty and endless speculation about further tax rises given it would only take a small downgrade in the UK’s growth prospects to wipe the buffer out.”

The decision on income tax was said to be communicated to the Office for Budget Responsibility (OBR) on Wednesday, when the chancellor submitted a list of “major measures” to be included in her Budget on 26 November, according to the FT.

An income tax rise would help her bridge a fiscal black hole estimated by some economists to be as much as £50bn, but it would also break Labour’s clear manifesto pledge not to raise income tax, national insurance or VAT.

Last weekend The Independent reported that just one in five voters would back plans that break the manifesto pledge to not increase taxes on working people.

However, the report from cross-party think tank Demos also indicated that the political damage that would be inflicted by any increase to income tax would be reparable if it was paired with taxes on the wealthy and targets to improve public services.

The report showed that just 20 per cent of the public believe it is acceptable for the government to break promises on tax, even if that is what the country needs.

The prospect of a manifesto breach drew criticism earlier this month from Labour’s new deputy leader, Lucy Powell, who said it would damage “trust in politics”.

Having vowed not to return to “austerity” through deeper spending cuts, the chancellor could now have to rely on increases in a wider range of smaller taxes if she is to stick to her self-imposed rules on debt and borrowing.

The Financial Times suggested that one option would also be to reduce income tax thresholds while keeping tax rates the same, which could raise billions of pounds for the Treasury.

Ms Reeves began November with a speech in which she failed to rule out an income tax hike, having previously said that Labour would stick to its manifesto commitments.

On Monday, she told the BBC that sticking to those commitments “would require things like deep cuts in capital spending” that could harm productivity growth.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks