UK house prices rebound in July after stamp duty changes cause summer dip

The UK’s average house price increased from £271,619 in June to £272,664 in July

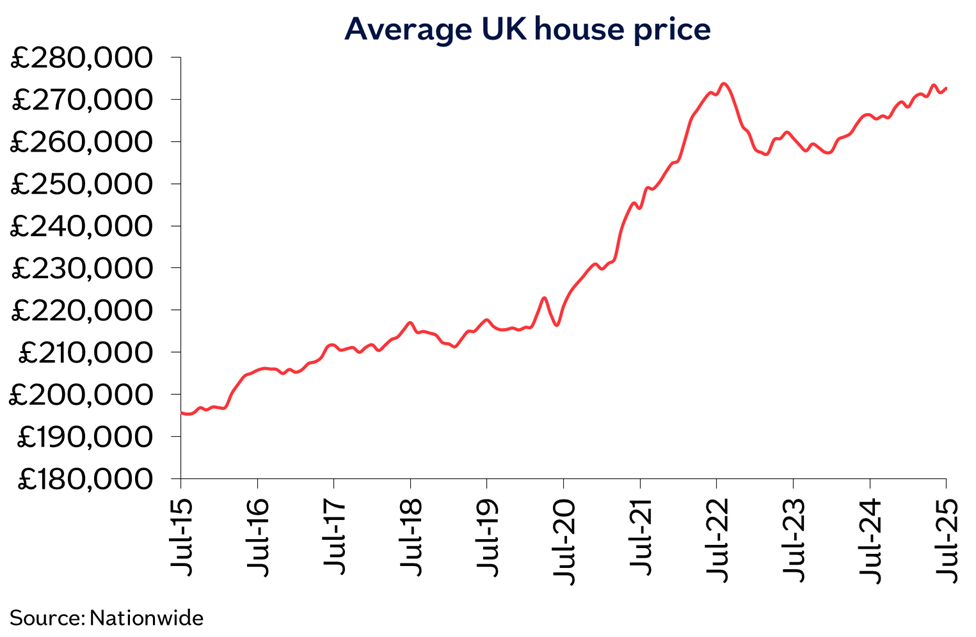

The UK house market has rebounded in July after a dip in June, according to building society Nationwide.

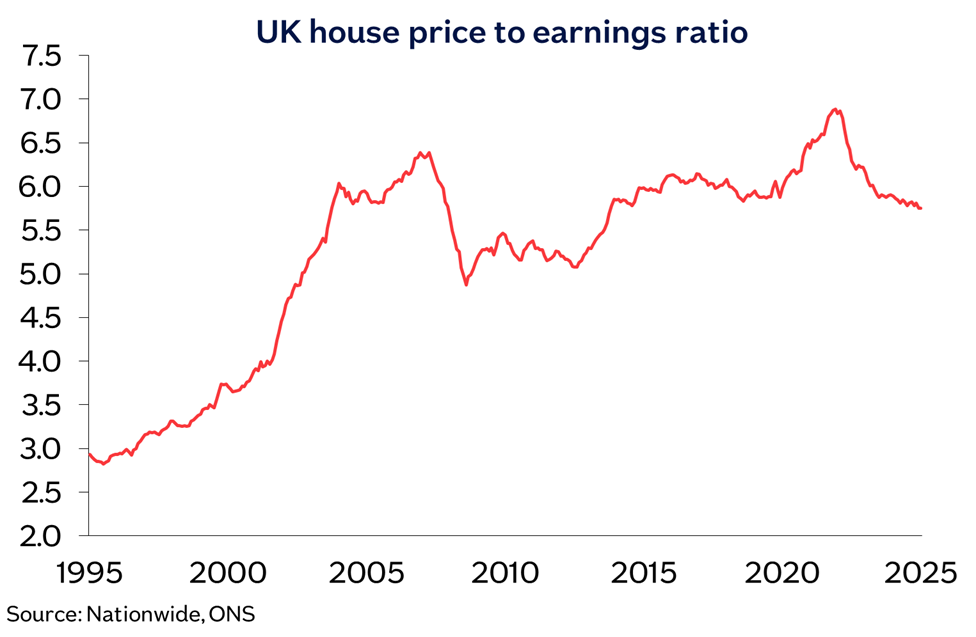

Annual house price rates grew from 2.1 per cent to 2.4 per cent while the house price to earnings ratio fell to its lowest level in over a decade.

The average house price increased from £271,619 in June to £272,664 last month, the organisation said.

Robert Gardner, Nationwide's Chief Economist, in the building society’s report last week following the instability caused by the end of the stamp duty holiday “activity appears to be holding up well.”

“Indeed, 64,200 mortgages for house purchase were approved in June, broadly in line with the pre-pandemic average, despite the changed interest rate environment,” he said.

Mr Gardner said after deteriorating “markedly” in the wake of the pandemic, housing affordability has been steadly improving due to a strong period of income growth, a more subdued house price growth and a “modest” decrease in mortgage rates.

“While the price of a typical UK home is around 5.75 times average income, this ratio is well below the all-time high of 6.9 recorded in 2022 and is currently the lowest this ratio has been for over a decade. This is helping to ease deposit constraints for potential buyers, as has an improvement in the availability of higher loan to value mortgages,” Mr Gardener said.

Nationwide’s reports show the interest rate on a typical five-year fixed-rate mortgage is around 4.3 per cent for a borrower with a 25 per cent deposit. This is over three times the all time low in autumn 2021 but below the high of 5.7 per cent reached in late 2023.

The building society’s chief economist said: “Unemployment remains low, earnings are still rising at a healthy pace (even after accounting for inflation), household balance sheets are strong and borrowing costs are likely to moderate a little further if Bank Rate is lowered further in the coming quarters as we, and most other analysts, expect.

“Providing the broader economic recovery is maintained, housing market activity is likely to continue to strengthen gradually in the quarters ahead.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks