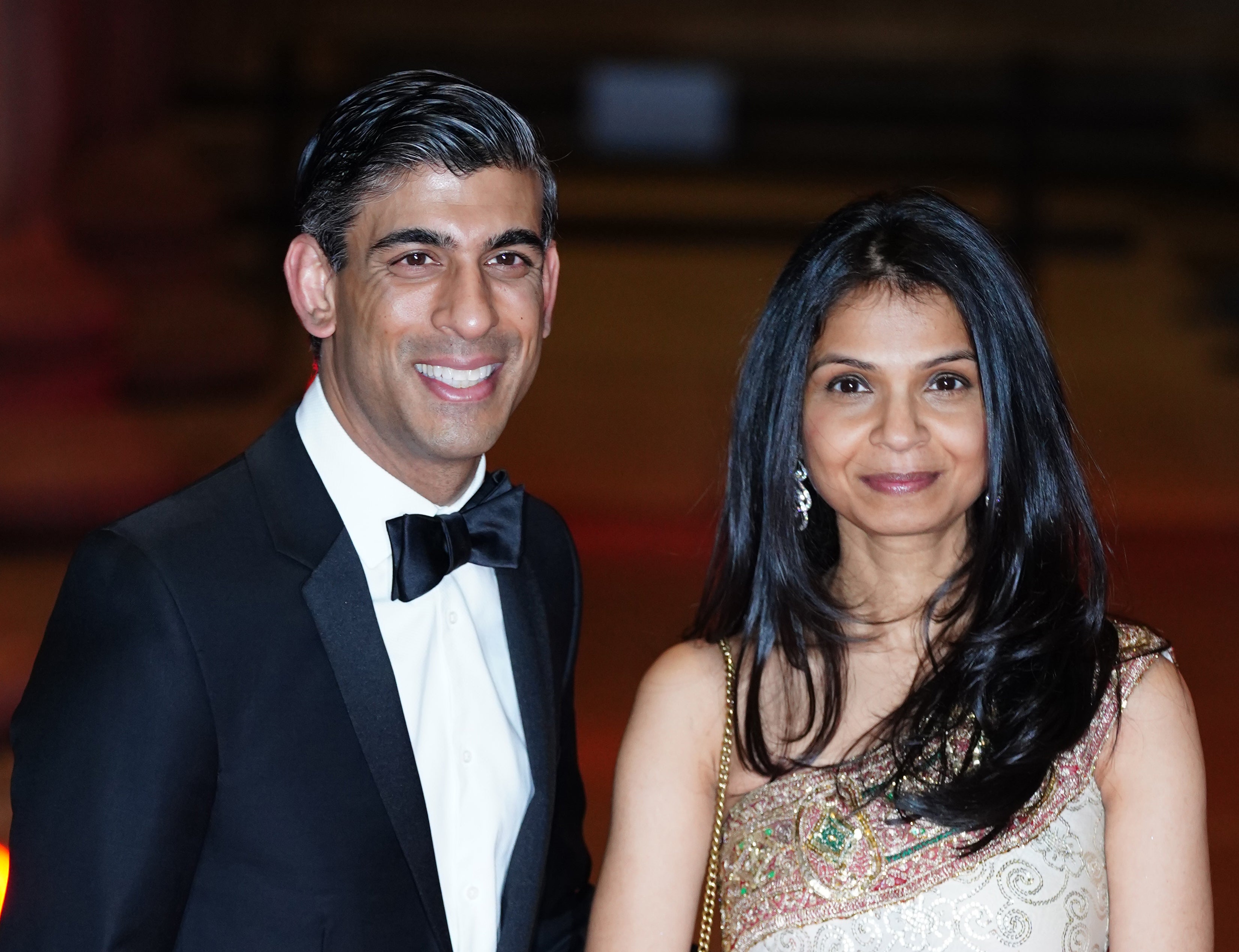

Rishi Sunak and Akshata Murty have done the right thing only because The Independent reported the truth

The chancellor’s wife has belatedly agreed to pay UK tax on her worldwide income

Rishi Sunak and Akshata Murty, his wife, have done the right thing too late, and only because The Independent revealed her arrangements for reducing her tax liability.

As Anna Isaac, our economics editor, reported on Wednesday, Ms Murty is a non-dom: that is, she is a non-domiciled person for tax purposes.

As a British resident, she has to pay tax on her UK income, but as an Indian citizen who intends to return to India eventually, she can choose to have her income earned outside the UK taxed outside the UK. Non-doms are required to pay £30,000 a year for this privilege, which expires after they have lived here for 15 years – a change introduced by George Osborne as chancellor the last time there was a fuss about the tax treatment of non-doms.

Everything Ms Murty has done has been lawful. The rules for non-doms seem peculiar, but are in fact a reasonable approach for a modern, open economy. They strike a balance between encouraging mobile, rich people to live in the UK and raising taxes from them.

However, Mr Sunak has failed to be open about his family finances. It has been reported that he disclosed his wife’s non-dom status to the permanent secretary of his department – then called Housing, Communities and Local Government – when he was first appointed a junior minister in 2018, and that he reported it to the permanent secretary at the Treasury when he became chief secretary in 2019, but The Independent has also reported that senior officials at the Treasury say they feel “uncomfortable” that they were not informed.

When The Independent asked about his wife’s status, it was met with a wall of silence. As the fact of Ms Murty’s status was not denied, and we were confident in our sources, we reported it. Only then did a spokesperson for Ms Murty confirm that she was a non-dom, and issue a statement wrongly suggesting that, because she is an Indian citizen, she had no choice in the matter.

Mr Sunak defended himself and his wife, implying that it was sexist to hold him responsible for her finances and that the Labour Party was “smearing” her in order to have a go at him. Neither charge is justified. The ministerial code is rightly clear that “interests of the minister’s spouse or partner and close family” should be declared if they “might be thought to give rise to a conflict”. And the questions being asked by Pat McFadden, the shadow chief secretary to the Treasury, are important – and in the public interest.

This was in effect conceded by Ms Murty in her statement on Friday night, in which she renounced the “remittance basis” for paying tax – that is, paying UK tax only on income remitted to the UK – and undertook to pay UK tax on an “arising basis” on income wherever in the world it arises. This means that she will pay more tax than she is legally obliged to do, but it recognises that her husband is in a special position.

As chancellor, he is asking the people of the UK to pay more in tax – quite rightly, in The Independent’s view – but it would be wrong to do so while his family benefits from a tax arrangement that is not available to most UK citizens.

Mr Sunak and Ms Murty have therefore done the right thing, rather late in the day and under pressure. Now perhaps Mr Sunak could turn his attention to our latest report: that while he was chancellor he was the beneficiary of trusts in the British Virgin Islands and the Cayman Islands.

Instead of stonewalling our inquiries again, Mr Sunak should explain what these arrangements are and how they are compatible with the idea of fair taxes at a time of national financial stringency.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks