‘We took the gamble’: The hard choices facing 23 million Americans as healthcare costs soar

‘Our 2025 plan went up nearly $300 per month, and my husband and I are freelance musicians/teachers with low income, so we don’t have that kind of extra money,’ one policyholder said

Kate Bivona, a 37-year-old musician and teacher in Tempe, Arizona, was shocked when she saw the new 2026 premiums for the health insurance plan that she and her husband used in 2025.

Last year, the couple was paying $118 per month for the silver-tier plan on the Healthcare Marketplace, the federal site where individuals without access to insurance through work can enroll in a plan. Now, that cost would be more than $400, an amount their roughly $50,000 combined annual income couldn’t absorb.

“I felt angry and really worried,” she told The Independent via email. “Our 2025 plan went up nearly $300 per month, and my husband and I are freelance musicians/teachers with low income, so we don’t have that kind of extra money.”

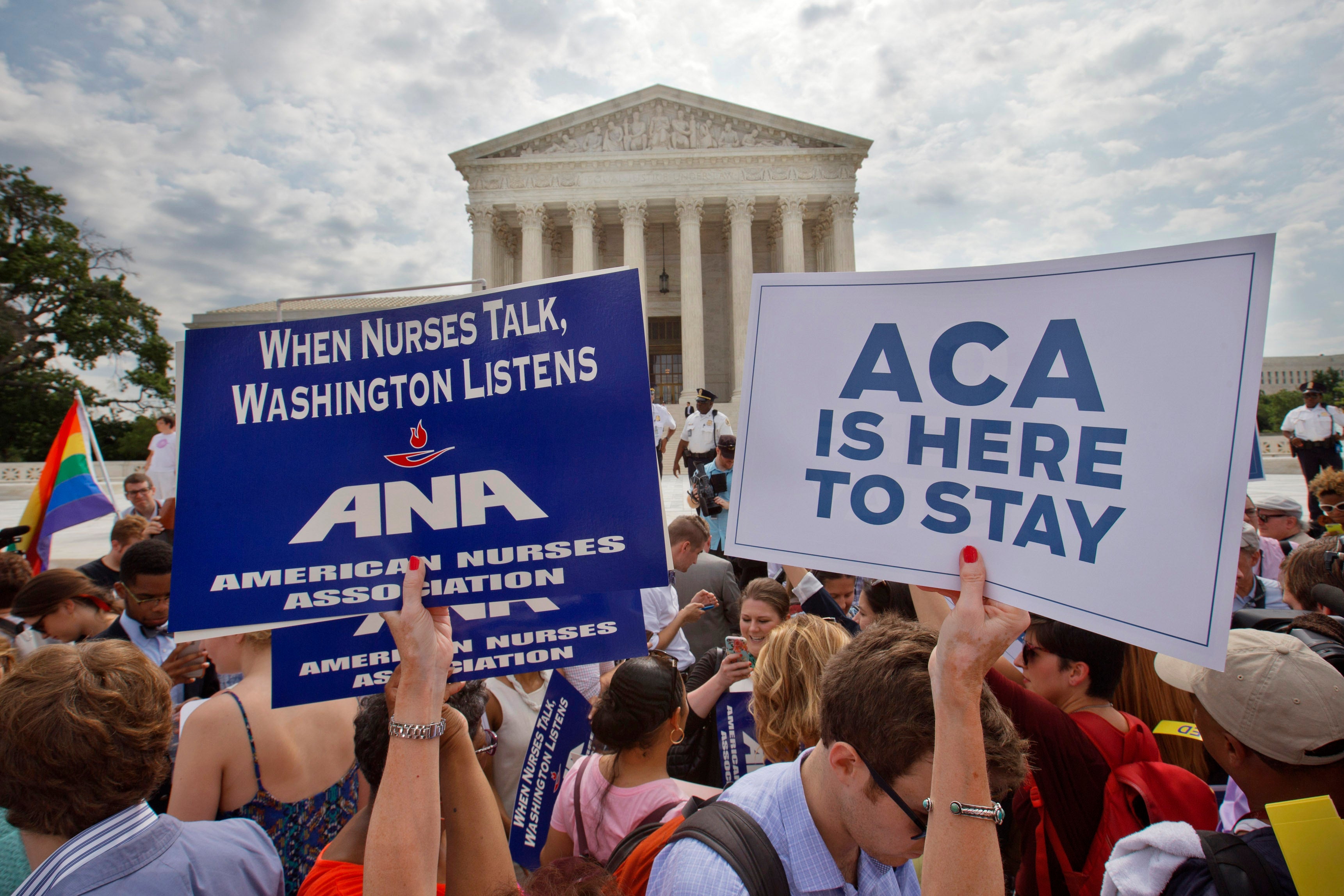

On December 31, 2025, Congress failed to renew boosted premium tax credits from the pandemic-era that had lowered health insurance costs under the 2010 Affordable Care Act, otherwise known as “Obamacare.” Now that those enhanced credits have expired, premiums are set to soar by an average of 114 percent, according to health policy research group KFF.

The rise in premiums - and the fact that at least one in five consumers say their healthcare costs have increased faster than food or utilities - have 66 percent of Americans entering 2026 more worried about affording medical coverage than groceries, utilities and gas, according to KFF.

Some premium increases have been devastating for Americans. One Maine woman with multiple health conditions saw her premiums rise from $201 to $2,864, leaving her with no choice but to cancel her health insurance. A West Virginia couple saw their premium rise from $255 a month to $2,155, nearly three times their mortgage of around $750, according to a report from The Wall Street Journal.

For many others, the situation is less extreme but is still pushing them onto a ledge: where it’s a tough choice between the financial risk of higher premiums or less protection for their health by downgrading coverage.

Bivona is among the nearly 23 million Americans who faced this decision. She and her husband chose to downgrade their plan from silver to bronze.

Silver plans typically have lower deductibles (what you have to pay out of pocket before your plan’s full coverage kicks in), and, in some cases, offer co-pays (flat fee) for visits to your doctor and specialists. Bronze plans have lower premiums than silver plans but also have higher deductibles and tend to cover less of your medical expenses once you meet your deductible, according to HealthCare.gov.

While the couple is grateful to still have coverage, their plan leaves them on the hook for the full cost of most claims until their spending reaches the $18,000 deductible.

“We could not afford the premium increase and had to make the call to downgrade to a bronze plan with an insanely high deductible/out of pocket maximum,” she told The Independent in an email. “We are pretty healthy and don’t generally have to go to the doctor more than once a year, so we took the gamble.”

That gamble has Bivona worried that an unexpected medical expense could put them in a dire financial situation.

“I keep praying we don’t have an accident,” she added.

Suman Bhattacharyya, 49, an independent writer and journalist based in Philadelphia, found himself in a similar situation to the Bivonas during the open enrollment period for healthcare this year. He was so nervous about the costs, that he put off finding out how much the premiums might cost until near the deadline.

“Given how politically charged healthcare premium discussions were at the federal level, I avoided checking Pennie, Pennsylvania’s health insurance exchange and plan selection platform, until very close to the deadline,” Bhattacharyya told The Independent in an email.

“I spoke with friends who are also on ACA plans for support, and one friend and I decided to open the site at the same time to see how bad the increase would be.”

The premium increase was more than he expected it would be - around $200 for his gold-tier plan - meaning he would pay $1,124 a month. He could save money by downgrading to a silver plan but needed the higher coverage because he has pre-existing conditions that require more care.

In the end, Bhattacharyya found a different gold-tier plan that kept premiums near the $934 he was paying monthly in 2025. Sticking with his 2025 healthcare plan would have put him in a tough financial position, he said.

“I would have had to eat the cost, which wouldn’t have been easy, especially since my income can be variable,” he said. “It likely would have meant cutting expenses elsewhere to make the numbers work, since my pre-existing conditions require me to maintain this level of coverage.”

Eating out and groceries are two areas he would’ve cut back on first, Bhattacharyya said. At times in 2025, Bhattacharyya’s premiums amounted to a considerable portion of his income.

“My income fluctuated quite a bit,” he said. “In a bad month, for example, a fixed cost like this was harder to absorb, taking up as much as a third of my income.”

For now, it appears increased healthcare coverage costs will remain unless Congress can agree to extend them.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks