Tesla to shift from cars to AI and robots as revenue slumps for first time

Tesla will stop selling its Model S sedans and Model X SUVs – flagship vehicles that established the company as a leader in the EV market

Tesla has announced a $2 billion investment in Elon Musk’s artificial intelligence venture, xAI, alongside confirmation that production of its Cybercab robotaxi remains on schedule for this year.

This move underscores Mr Musk’s ambition to transform Tesla from a mere electric vehicle manufacturer into a dominant AI firm, a strategy crucial for the company’s approximate $1.5 trillion valuation. The update on production is particularly vital for investor confidence, given Tesla’s history of not always meeting its chief executive’s ambitious timelines.

However, these expansive plans – which also include humanoid robots, Semi trucks, and Roadster sports cars – will necessitate substantial factory investments. Chief Financial Officer Vaibhav Taneja stated that capital expenditures are projected to exceed more than twice the $8.5 billion allocated for 2025.

Tesla’s shares initially climbed by around 3.5 per cent in after-hours trading, though they later pared these gains to settle up 1.8 per cent following the disclosure of the capital expenditure details.

Thomas Monteiro, a senior analyst at Investing.com, commented that Tesla is "entering a transition phase" where it is asking investors to underwrite potential revenue from its self-driving software and robotaxi ventures before a recovery in traditional auto sales.

"(That) makes rollout metrics - not deliveries - the most important leading indicator from here," Monteiro said.

Musk, who has made a number of inaccurate forecasts about robotaxi rollout, said he expected to have fully autonomous vehicles in a quarter to half of the United States by the end of this year. He had said robotaxis would reach half of the U.S. population by the end of 2025 - before later narrowing that goal to deployment in the top eight to 10 metropolitan areas.

The company has since missed those targets with a limited robotaxi service in Austin, Texas. Tesla's core EV business, which still accounts for most of the company's current revenue, has been under strain as rivals roll out newer models, often at lower prices. A U.S. tax incentive for electric vehicles has also ended, and Musk's far-right political rhetoric has alienated some customers.

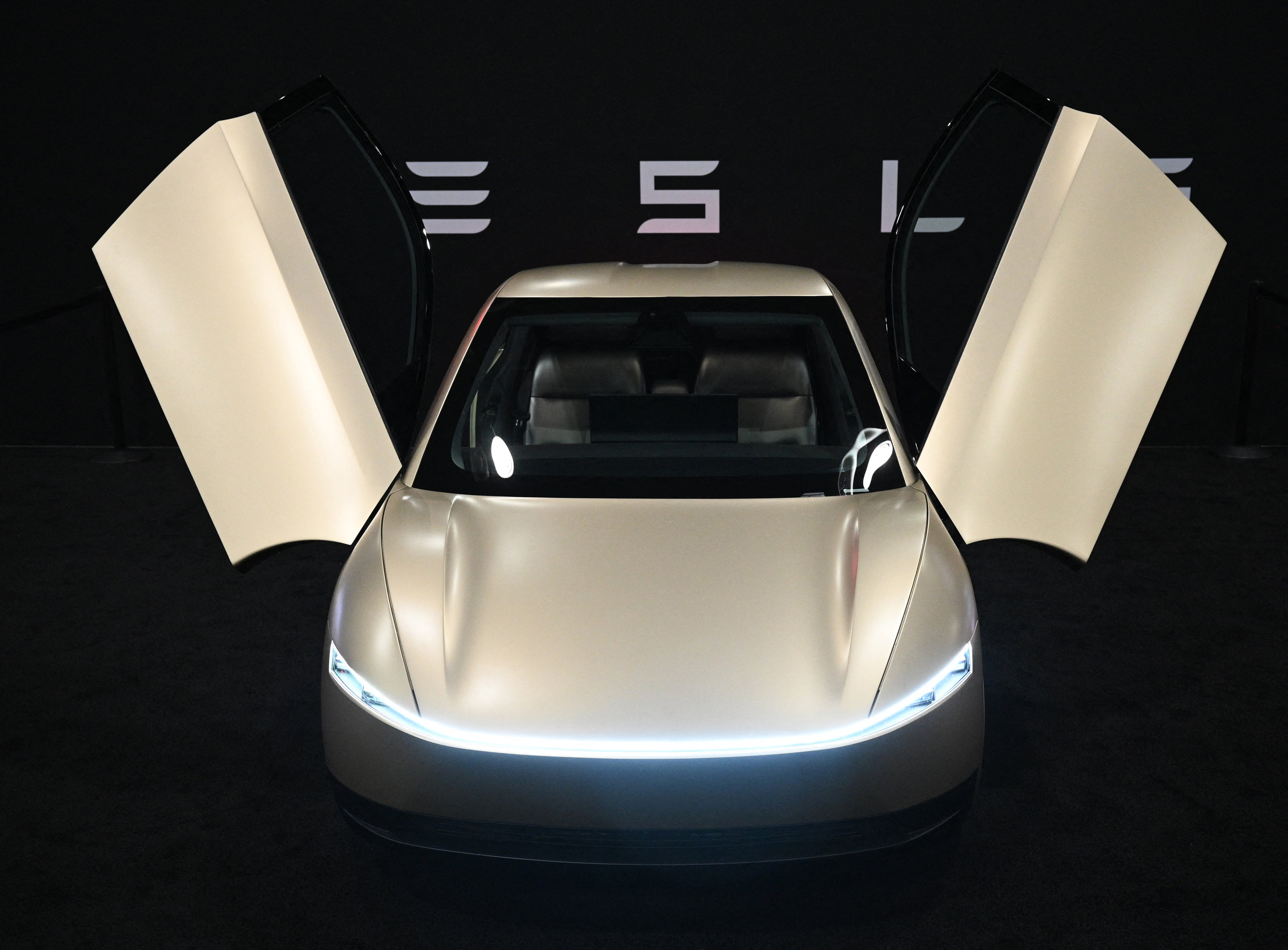

On Wednesday, Musk told analysts on a conference call that Tesla would stop selling its Model S sedans and Model X SUVs - flagship vehicles that once established the company as a leader in the EV market but have since dwindled to account for a small fraction of revenue. The factory space will be used to build robots.

Tesla's revenue fell about 3% to roughly $94.83 billion in 2025, marking the company’s first annual decline in revenue.

To defend volumes, Tesla has relied heavily on discounts and incentives, and introduced lower-priced trims of its best sellers. Wall Street expects the company to deliver 1.77 million vehicles in 2026, representing an 8.2% increase, according to Visible Alpha data.

Adjusted earnings per share of 50 cents in the fourth quarter topped Wall Street targets of 45 cents, according to LSEG data. Net income fell 61% to $840 million in the quarter.

Despite the sales drop, the company's automotive gross margin excluding regulatory credits came in at 17.9%, up from 13.6% a year earlier and well above expectations of about 14.3%, according to Visible Alpha.

Its energy generation and storage business has proven a notable bright spot, benefiting from sustained demand for grid-scale batteries used to support renewable power and stabilise electricity networks.

Revenue from the energy generation and storage segment rose 25.5% to a record $3.84 billion in the December quarter, trouncing analysts' estimates of $3.46 billion.

‘Scorching hot AI boom’

Investors have increasingly focused on Musk's push into self-driving technology and robotics, with many looking for proof that the autonomy story is moving from promise to product.

An investment by Tesla in xAI was long expected. Analysts have said Tesla will benefit from xAI's advanced models and growing valuation.

"With Tesla's legacy EV business slowing, Tesla investors can take part in the scorching hot AI boom," said Andrew Rocco, a stock strategist at Zacks Investment Research.

But Musk warned about a brewing shortage of memory chips that could hamstring Tesla's plans in the coming years, adding that it should look to build a chip-making plant to protect itself.

"If we don't do that, we're just going to be fundamentally limited by supply chain," he said. "In a worst-case geopolitical situation it would be quite a severe situation."

The rapid build-out of artificial intelligence infrastructure by U.S. tech firms has absorbed much of the world's memory-chip supply, which has lifted prices as manufacturers prioritize components for higher-margin data centers over consumer devices.

Investors have also been looking for signs that Tesla's Full Self-Driving and robotaxi rollouts are advancing, including updates on regulatory progress and clearer timelines for the purpose-built Cybercab, which is designed without a steering wheel or pedals.

Cybercabs will be added to its robotaxi service that currently relies on Model Y vehicles running a version of Full Self-Driving and will also be available for consumers to buy. Last week, Musk said initial production of the Cybercab robotaxi and the humanoid robot Optimus would be "agonizingly slow" before accelerating over time. On Wednesday, he said Tesla was not expecting significant Optimus production volume until the end of 2026.

There are also regulatory hurdles involved with producing the Cybercab, which Musk has said will have no steering wheel or pedals - contrary to current federal design standards.

He has continued to predict rapid progress for Full Self-Driving, a vision he has outlined for nearly a decade, but has not provided firm dates for regulatory approval or broad unsupervised deployment. Still, Tesla's shares rose about 11% in 2025. An $878 billion pay package for Musk, pegged to a series of lofty operational and valuation milestones, reassured investors of his commitment to Tesla among his other business and political interests.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks