Why Nvidia earnings report could make-or-break AI industry

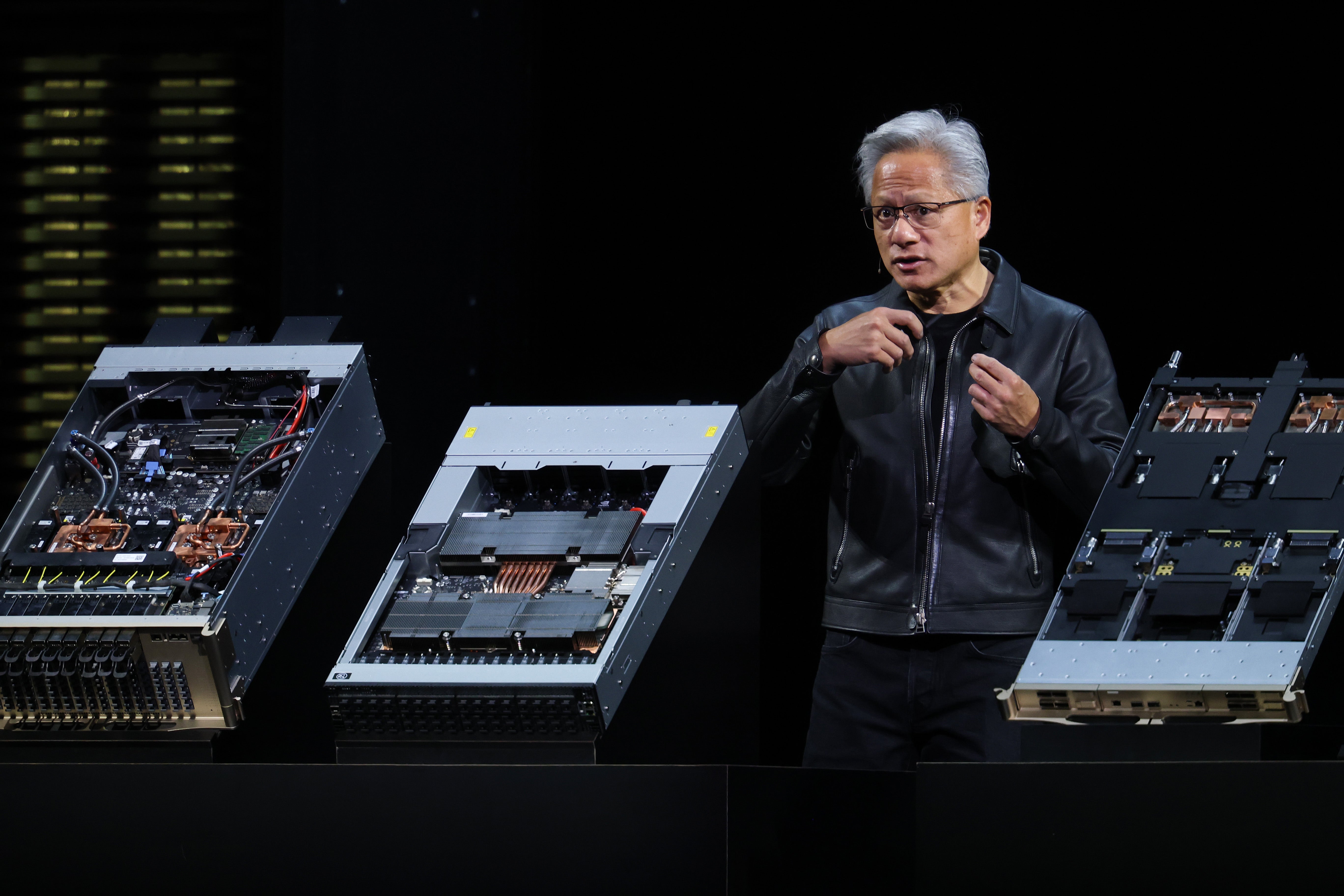

Nvidia CEO Jensen Huang said that the company has $500 billion in bookings for its advanced chips through 2026

Wall Street’s substantial artificial intelligence investments face a critical test this Wednesday with Nvidia’s earnings report, as investors seek reassurance that market bubble concerns are unfounded.

Three years post-ChatGPT, unease suggests the AI boom outpaced fundamentals, with business leaders citing ‘circular deals’ – where partners inflate revenues – as adding to bubble risk.

This apprehension prompted major investors to divest AI holdings, fuelling fears of an imminent sell-off.

Peter Thiel’s hedge fund notably sold its entire Nvidia stake in Q3, a move echoed by SoftBank CEO Masayoshi Son, who reinvested in OpenAI.

These doubts have seen Nvidia shares fall 7.9 per cent this November, despite a staggering 1,200 per cent surge over three years. The broader market declined 2.5 per cent this month.

"With every quarter that goes by, Nvidia earnings become more important in terms of clarification on where AI is moving and how much spending is being done," said Brian Stutland, chief investment officer of Nvidia investor Equity Armor Investments.

Notwithstanding bubble fears, demand for Nvidia's chips remains strong, with cloud giants including Microsoft MSFT.O investing billions in AI data centres.

Nvidia is likely to report a more than 56 per cent jump in its fiscal August-October quarter revenue to $54.92 billion, according to data compiled by LSEG, a far cry from the triple-digit growth it witnessed for many quarters as it faces tougher comparisons. The company has surpassed expectations for the past 12 quarters, though the delta has shrunk.

Nvidia CEO Jensen Huang said last month that the company has $500 billion in bookings for its advanced chips through 2026.

"The old Wall Street adage 'one stock does not a market make' - that would be incorrect here," said Neil Azous, portfolio manager of the actively managed Monopoly ETF that holds Nvidia shares. "Nvidia has the ability to make a market."

But Nvidia's chips are central to "Big Short" investor Michael Burry's bet against the company. Burry, who recently shut his hedge fund, argued that large cloud providers were artificially boosting earnings by extending the depreciable life of AI compute gear, such as Nvidia's chips.

Nvidia now updates chips annually, making older models appear obsolete faster, even as the resale market thrives.

For now, Nvidia is struggling to supply enough chips.

While contract chipmaker TSMC is adding advanced-packaging capacity to overcome a key bottleneck and plans to keep expanding through 2026, Nvidia is also rolling out more complex and larger systems that bundle graphics processors, central processing units, networking gear and a range of cooling options.

That, in addition to the ongoing ramp-up of its top-of-the-line Blackwell chips and upcoming Rubin processors, has burdened margins.

Nvidia is expected to report that its adjusted gross margin shrunk nearly two percentage points from the year-ago period to 73.6 per cent in the third quarter. Net income likely grew 53 per cent to $29.54 billion.

Investors are watching to see how big AI deals including Nvidia's $100 billion investment in OpenAI and $5 billion stake in chipmaker Intel will affect its balance sheet. Nvidia had cash and cash equivalents of $11.64 billion as of 27 July.

China is another overhang. Nvidia cannot ship its most advanced chips there under U.S. export curbs and Huang has said there are "no active discussions" on selling Blackwell in the market despite speculation of a possible deal for a scaled-down version.

Nvidia stripped China from its forecast for advanced processors last quarter.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks