Bitcoin price takes a dive as crypto bank liquidates

Demise of Silvergate Bank pushes overall cryptocurrency market below $1 trillion

The price of bitcoin is once again on the slide after another crypto-friendly institution announced plans to liquidate.

Silvergate Bank said that it would begin winding down operations in accordance with applicable regulatory processes, claiming that all customer funds would be repaid.

“In the light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of bank operations and a voluntary liquidation of the bank is the best path forward,” the company announced in a statement published on Wednesday evening.

“The bank’s wind down and liquidation plan includes full repayment of all deposits.”

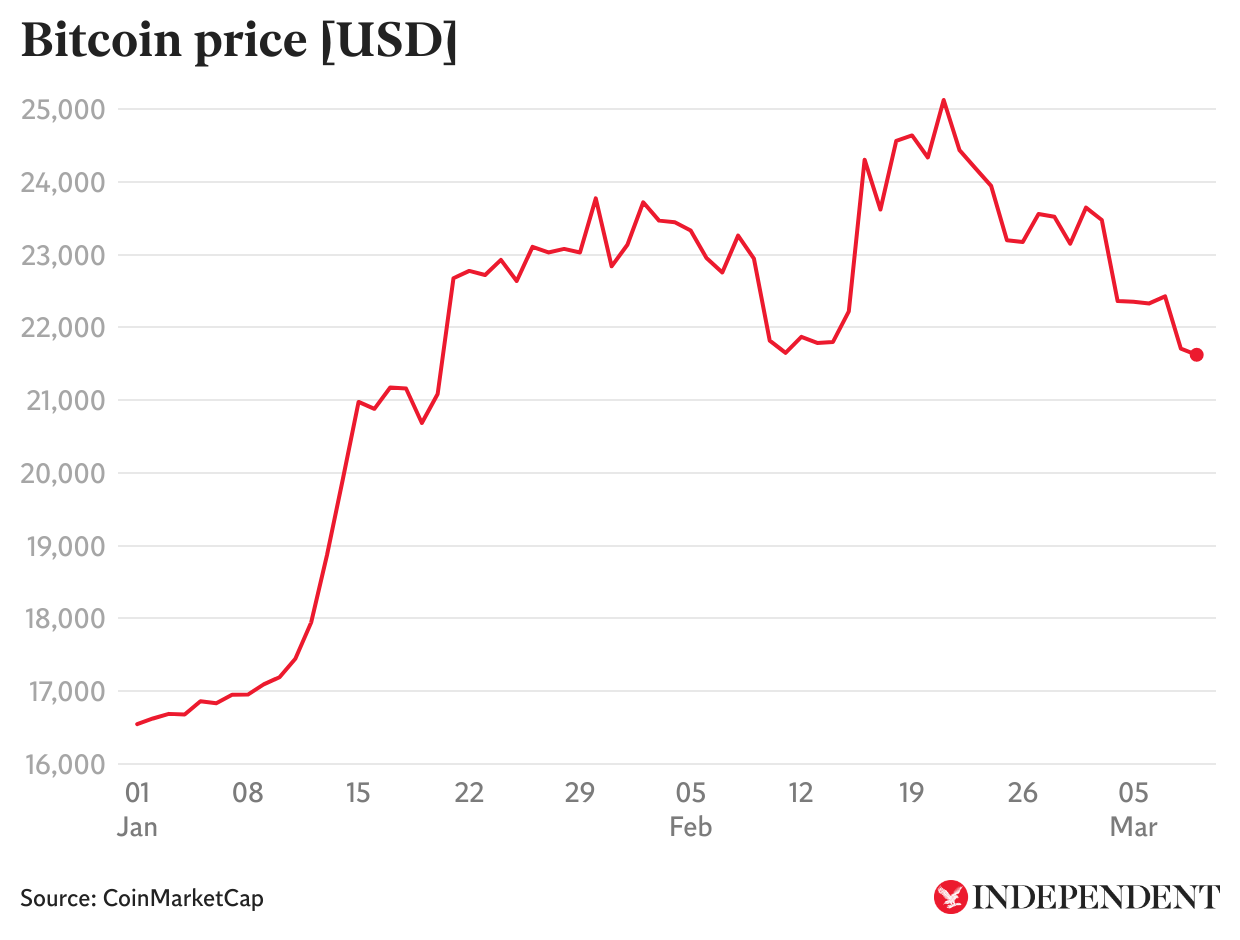

Bitcoin suffered a minor flash crash following the announcement, having already begun to dip in price when concerns about the bank first began to surface last week.

Since the start of the month, the world’s biggest cryptocurrency is down 8 per cent, having fallen below $21,700 on Thursday morning.

Several other leading cryptocurrencies, including Ethereum (ETH), Cardano (ADA) and Dogecoin (DOGE) also saw notable losses, pushing the overall crypto market cap below $1 trillion for the first time since mid February.

The demise of one of the most prominent banks within the cryptocurrency industry, coming less than a year after the collapse of leading exchange FTX, has once again raised concerns about the health of the crypto sector in the US.

“As the impact of FTX’s collapse continues to ripple outward, today we are seeing what can happen when a bank is over reliant on a risky, volatile sector like cryptocurrencies,” Ohio Democrat Senator Sherrod Brown said in a statement.

“I’ve been concerned that when banks get involved with crypto, it spreads risk across the financial system and it will be taxpayers and consumers who pay the price. That’s why I am continuing to work with my colleagues in Congress and financial regulators to establish strong safeguards for our financial system from the risks of crypto.”

Some industry commentators claimed the bank’s downfall was related to issues with the broader financial sector, rather than being specific to cryptocurrency.

“The problem is not about crypto, but concentration risks,” Sheila Warren, CEO of the Crypto Council for Innovation, told The Independent.

“In this case, this is a voluntary wind down under California law, which implies that they will be able to make depositors whole. Neither taxpayer money, nor the FDIC [Federal Deposit Insurance Corporation], are involved.

“Hopefully, this situation serves as a needed reminder to regulators of the risk of concentration, which is certainly not unique to the crypto industry, and will cause them to encourage responsible distribution across the banking sector.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks