IRS unveils federal income tax brackets for 2026 — how those changes affect you

Tax rate percentages will stay the same thanks to Trump’s One Big Beautiful Bill

The IRS has unveiled new federal income tax brackets to account for inflation - with the hope of providing relief for some Americans when they file their taxes for next year.

Despite its partial closure due to the government shutdown, the agency shared details Thursday of the new federal income tax brackets and standard deductions, which apply to tax year 2026 for returns filed in 2027.

The IRS lets most filers lower their taxable income by taking the standard deduction, which is a flat amount based on filing status and age, according to NerdWallet.

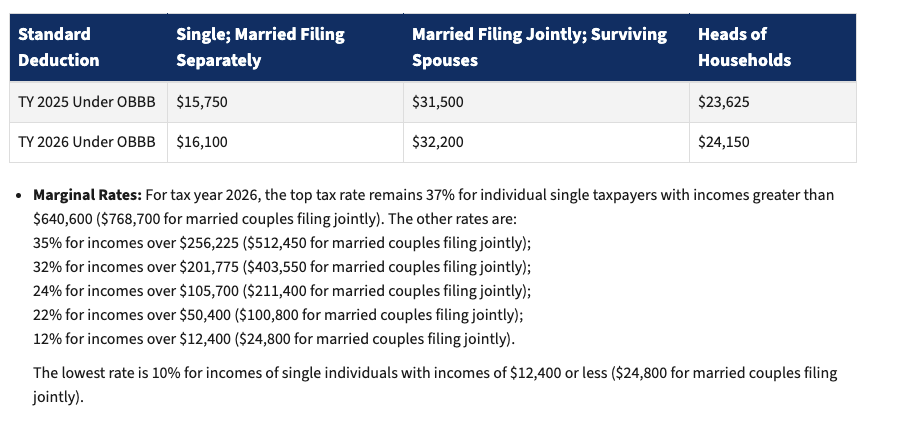

For 2026, the standard deduction will be raised from $31,500 to $32,200 for married couples filing jointly. For single taxpayers and married people filing separately, the standard deduction will increase from $15,750 to $16,100.

The IRS also shared changes to individual income tax brackets. While tax rate percentages will stay the same, thanks to Trump’s One Big Beautiful Bill that passed in July, the earning threshold to enter a new tax bracket has been adjusted for inflation.

For 2026, the top rate of 37 percent applies to individuals with taxable income above $640,600 and married couples filing together earning $768,700 or more.

Raising the earning threshold could potentially create savings for some Americans who haven’t received a pay raise to counteract the rising cost of food, housing, gasoline and other necessities.

The IRS makes adjustments each year, typically in October or November, to avoid what is known as “bracket creep,” which occurs when inflation pushes people into higher tax brackets, forcing them to pay more come Tax Day.

Several other changes beyond the federal tax brackets were shared Thursday, including changes to HSAs and FSAs.

Monitor your credit scores effortlessly.

Create an account today.

Terms and conditions apply.

ADVERTISEMENT

Monitor your credit scores effortlessly.

Create an account today.

Terms and conditions apply.

ADVERTISEMENT

Starting next year, people who contribute to a health flexible spending account (FSA) can contribute up to $3,400 and, if their plan allows it, carry over up to $680 into the next tax year.

The 2026 contributions for health savings accounts will increase to $4,400 for self coverage and $8,750 for family coverage.

The annual exclusion for gifts, which restricts how much taxpayers can give someone else without filing a gift tax return, will be $19,000 per person for 2026, which is the same as it was in 2025.

Other changes include an increase in the estate tax credit, which establishes a threshold for the taxation of estates upon a wealthy person’s death. In 2026, estates valued at or below $15 million will not be subject to estate tax, which is up from $13.9 million in 2025.

Meanwhile, the earned income tax credit, which was created to give a break to qualifying taxpayers with children, will also increase from $8,046 to $8,321.

The IRS announcements come a day after the agency said it would furlough nearly half of its workforce due to the government shutdown, which has now entered its ninth day.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks