UK economy grew by 0.1% last quarter despite Budget uncertainty

The UK economy grew modestly again in the last three months of 2025

The UK economy grew modestly again in the last three months of 2025 even amid pressure from budget uncertainty, figures just released show.

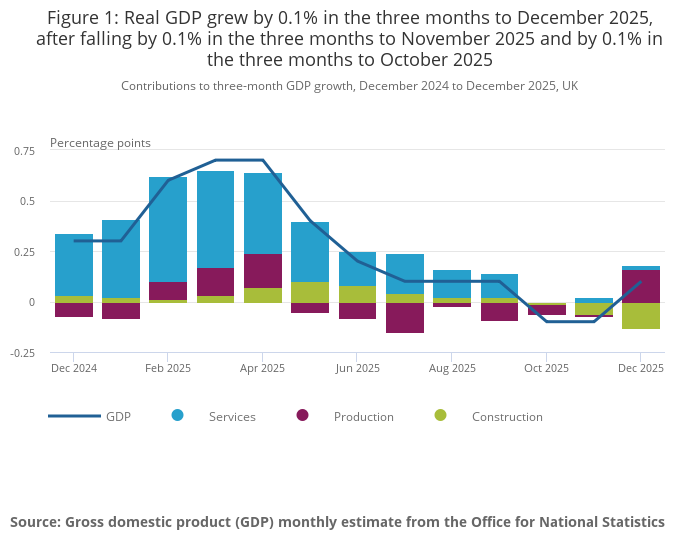

The Office for National Statistics (ONS) said UK GDP (gross domestic product) data grew by 0.1 per cent in the final quarter between October and December last year, following growth of 0.1 per cent in the third quarter.

Some had suggested that fourth-quarter growth could tip slightly higher after stronger-than-expected activity in November and that clarity following the autumn Budget could have supported firms in the run-up to Christmas.

It is still expected that the first quarter of 2026 will show a stronger level of growth, but meaningful and sustained economic expansion remains dependent on inflation coming down and businesses adapting to new, higher levels of costs – while unemployment also remains above 5 per cent.

The prime minister said the figures showed the economy was growing. Writing on X/Twitter, he added: “I know there’s more to do, but we are heading in the right direction.”

Previous figures from the ONS showed that the economy contracted by 0.1 per cent in October and then expanded by 0.2 per cent in November (revised down from 0.3 in this latest publication) as the manufacturing sector was boosted by recovering production at Jaguar Land Rover after its major cyber attack.

The Bank of England on Thursday cut its growth forecast for 2026, from 1.2 per cent to 0.9 per cent, and for 2027, from 1.6 per cent to 1.5 per cent.

Liz McKeown, ONS director of economic statistics, said: “The economy continued to grow slowly in the last three months of the year, with the growth rate unchanged from the previous quarter.

“The often-dominant services sector showed no growth, with the main driver instead coming from manufacturing.

“Construction, meanwhile, registered its worst performance in more than four years.

“The rate of growth across 2025 as a whole was up slightly on the previous year, with growth seen in all main sectors.”

It comes after economists broadly predicted that the economy had grown by 0.1 per cent in the quarter, following growth of 0.1 per cent in the third quarter.

The British Chambers of Commerce (BCC) has called for government action to back up their words to aid economic recovery, noting that small businesses are holding back on spending due to lingering fears about rising taxation and other cost pressures.

“Improving the outlook now depends on restoring business dynamism. Government must move from strategy to delivery – backing infrastructure projects, speeding up planning decisions, addressing skills gaps, and strengthening export support – so firms can invest, export and grow,” said the BCC’s head of research, David Bharier.

The Trades Union Congress (TUC) meanwhile, pointed out that the year-long growth was a recent high, but general secretary Paul Nowak still urged the Bank of England to cut interest rates more quickly to stimulate spending.

“It’s welcome that the economy kept growing in December, and last year’s growth of 1.3 per cent was the strongest for three years,” he said.

“But many workers are not yet feeling the benefit in their pockets. Many working families don’t have any money left over to spend on the things that keep our economy moving.

“This doom loop must end. Ministers must stay laser-focused on cutting working people’s household costs and improving living standards this year.

“And the Bank of England must go further and faster with quickfire interest-rate cuts in the months ahead.

“Britain needs to finally move on from the cost-of-living crisis that’s kept us stuck for too long – the priority must be helping families to spend and businesses to invest.”

Victoria Scholar, head of investment at Interactive Investor, said: “It is likely that economic activity picked up after the budget once that cloud of uncertainty shifted to the rearview mirror in December.

“Plus, there could have been an improvement in the services sector with consumers spending on things like food and beverages, retail, and hotels around the festive season.”

Sandra Horsfield, at Investec Economics, said: “The big picture is that the UK economy had defied the gloomy popular narrative and outperformed expectations during 2025 – our forecast equates to GDP growth of 1.4 per cent for the full year, whereas the consensus forecast in January 2025 had been for 1.2 per cent GDP growth.

“We project a similar story of resilience and outperformance relative to consensus for 2026, as utilities investment and, eventually, housebuilding accelerate – the latter with a little help from further falls in interest rates too.

“The consensus forecast for this year is 1 per cent, against our own forecast of 1.3 per cent.”

However, RMS UK’s chief economist Thomas Pugh cautioned that there was an overriding factor which could hamper such optimistic predictions – “noisy leadership” from within government.

“Looking ahead, all the signs are that growth is now picking up sharply as budget uncertainty recedes. We expect growth to come in at around 0.5 per cent in the first three months of this year and the impact of previous rate cuts and sharp falls in inflation should start to show up as stronger consumer spending later in the year,” he said.

“The biggest risk now is that a protracted and noisy leadership contest which could reopen Pandora’s box of tax increases and inject a renewed bout of uncertainty into consumers and businesses, offsetting much of the improvement in the economic fundamentals.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks