Consumers left 'cashless' and 'cut off' by unacceptable IT failures, say MPs

With ever more people relying on online banking, MPs call on financial institutions to improve accountability to customers

Customers are being left “cashless and cut off” by unacceptable IT failures in the financial services sector, the Treasury Committee has said.

Prolonged IT failures should not be tolerated and the current level and frequency of disruption and consumer harm is not acceptable, according to the MPs.

With bank branches and cash machines disappearing, customers are increasingly expected to rely on online banking services. But these have been significantly disrupted due to IT failures, leaving customers without access to their financial services, the committee said.

Firms must resolve customer complaints and award compensation quickly, the MPs said, which may involve increasing financial sector levies to ensure regulators the Financial Conduct Authority, Prudential Regulation Authority and the Bank of England are sufficiently staffed.

Steve Baker, the Treasury Committee’s lead member for the inquiry, said: “The number of IT failures that have occurred in the financial services sector, including TSB, Visa and Barclays, and the harm caused to consumers is unacceptable.

“The committee, therefore, launched this inquiry to look ‘under the bonnet’ at what’s causing the proliferation of such incidents, and what the regulators can do to prevent and mitigate their impacts.

“The regulators must take action to improve the operational resilience of financial services sector firms.

“They should increase the financial sector levies if greater resources are required, ensure individuals and firms are held to account for their role in IT failures and ensure that firms resolve customer complaints and award compensation quickly.

“For too long, financial institutions issue hollow words after their systems have failed, which is of no help to customers left cashless and cut off.”

The report was agreed when Catherine McKinnell was interim chair, with Mel Stride having since been elected as the chair of the Treasury Committee.

The MPs said there is a “concerning” lack of consistent and accurate recording of data on IT incidents.

They said regulators must ensure they have the appropriate skills and experience to be able to intervene to improve the operational resilience of the financial services sector. If this proves challenging, the regulators should increase the financial sector levies to ensure that they can hire the staff with the expertise and experience required, the MPs said.

They must maintain a very low tolerance for service disruption by providing guidance on what level of impact should be tolerated, they said. The regulators cannot allow firms to set their own tolerance for disruption too high, the report said.

Individuals and firms should be held to account for their role in IT failures and poor operational resilience, it added.

MPs said if future incidents occur without sanction, parliament should consider whether the regulators’ enforcement powers are fit for purpose.

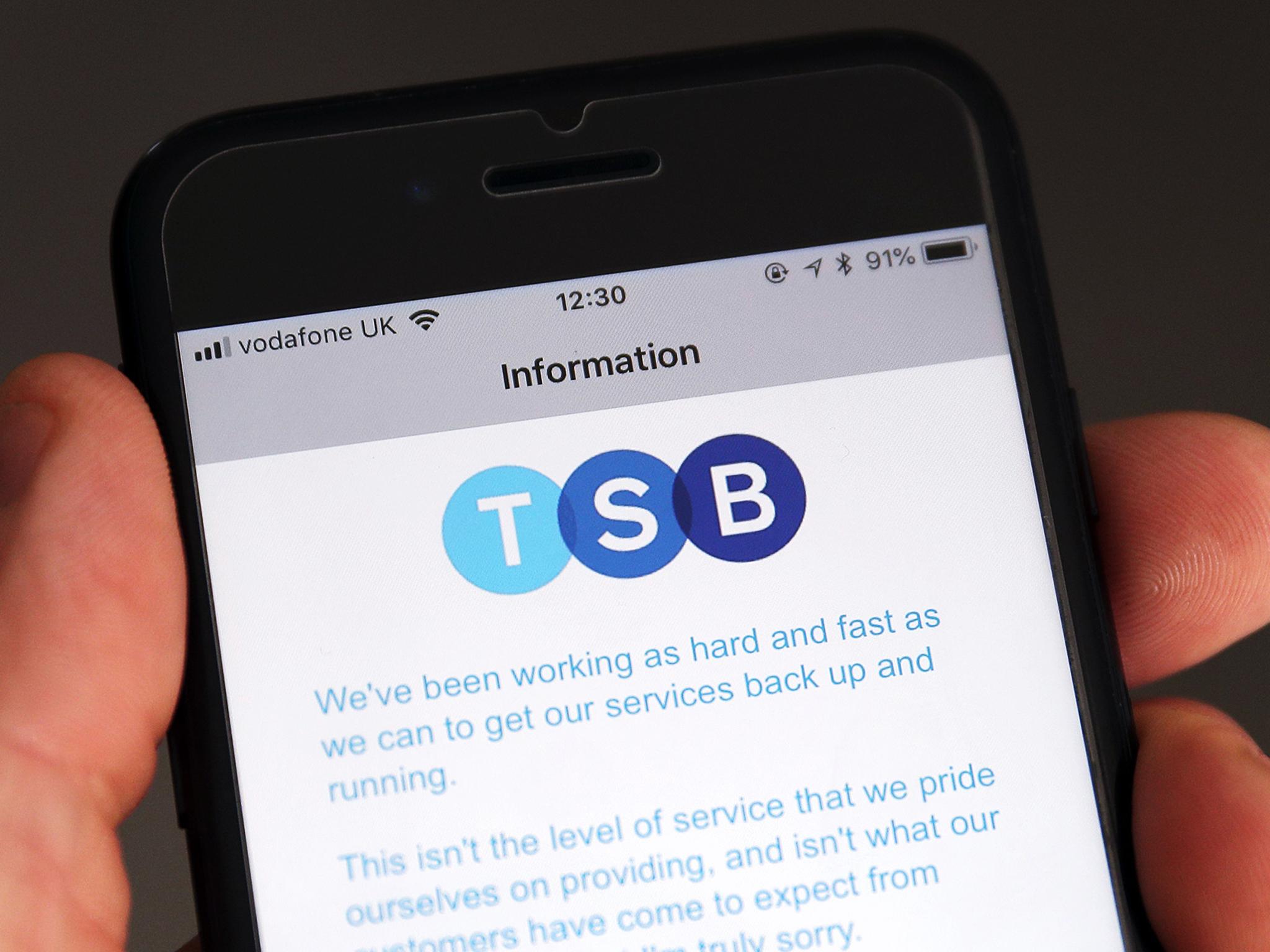

TSB suffered a high-profile IT failure last year that left customers unable to access their accounts, following the introduction of a new system.

Up to 1.9 million people lost access to online banking services.

The MPs said regulators must provide them with the outcome of their investigation into the TSB IT failure as soon as possible.

It said time and cost pressures may cause firms to cut corners when implementing change programmes, and regulators must adopt a proactive approach to ensure that customers are protected.

Mr Baker said: “For too long, we have waited for a comprehensive account of what happened during the TSB IT failure.

“Our inquiry into service disruption at TSB remains open.”

PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks