UK shoppers eye bargains as grocery price inflation drops

Spending on promotional items also surged by 10.9 per cent year-on-year

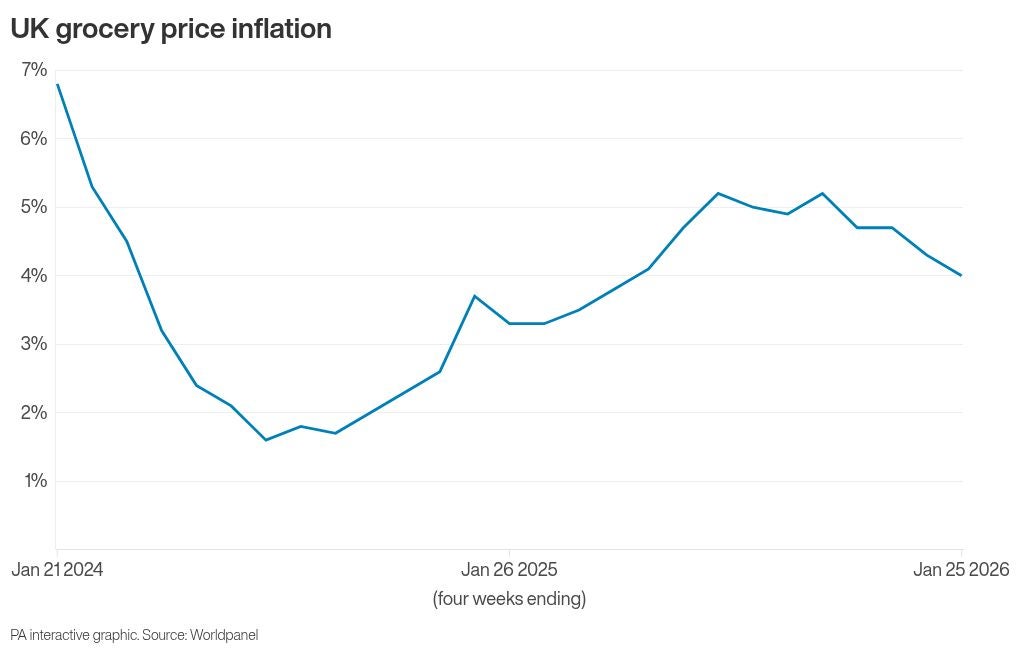

Grocery price inflation eased to 4 per cent in January, reaching its lowest point since April and offering some relief to households.

This decline from December’s 4.3 per cent coincides with a record 52.2 per cent of grocery sales now comprising supermarket own-label goods, according to market research firm Worldpanel by Numerator.

Spending on promotional items also surged by 10.9 per cent year-on-year, the fastest growth since October 2024.

Full-price product sales also saw a mere 1.7 per cent rise over the equivalent four-week period last year.

Fraser McKevitt, head of retail and consumer insight at Worldpanel, said: “For most shoppers, January is all about resetting household budgets, and this year was no exception.

“While grocery sales continue to grow and inflation eased to its lowest level in months, value remained front of mind for many, with own-label hitting a record high, accounting for more than half of all grocery spend.”

In January, almost a quarter of shoppers (23 per cent) sought high-protein food and 26 per cent looked for high-fibre products, a survey for Worldpanel found.

Sales of cottage cheese were up 50 per cent year on year, bought by 2.8 million households – about 600,000 more than last year.

Sales of fresh fruit and dried pulses were up 6 per cent year on year, alongside fresh fish, up 5 per cent, poultry, up 3 per cent, and chilled yoghurt, up 4 per cent.

So-called functional drinks, those marketed as providing health benefits such as energy, gut health or mood enhancement, were bought by 11 per cent of households, with spending up 13 per cent on last year.

Mr McKevitt said: “In a month when consumers typically look to rein in spending, it is notable how many are still willing to pay a premium for wellness, with functional drinks costing nearly four times as much as typical soft drinks at £4.69 per litre.”

Lidl was the fastest-growing bricks-and-mortar retailer, with sales up by 10.1 per cent over the 12 weeks to 25 January compared to the same period last year.

Sales at Ocado increased by 14.1 per cent, taking the online grocer’s market share to 2.1 per cent.

Sainsbury’s saw a 5.3 per cent rise in spending through the tills, while Tesco saw sales increase by 4.4 per cent to take 28.7 per cent of the market.

Waitrose achieved the fastest rise in average spending per trip among the grocers but its market share held steady at 4.7 per cent.

Sales of grocery items at M&S were 6.9 per cent higher compared to the same quarter last year.

Asda’s sales were down 3.7 per cent on a year earlier, while Co-op’s sales were 1.6 per cent lower.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks