London’s FTSE 100 tops milestone 10,000 mark for the first time after new year rally

The blue-chip index hit a new all-time intraday trading high on Friday

The FTSE 100 has risen above 10,000 points for the first time, reaching a major milestone following a rally at the turn of the new year.

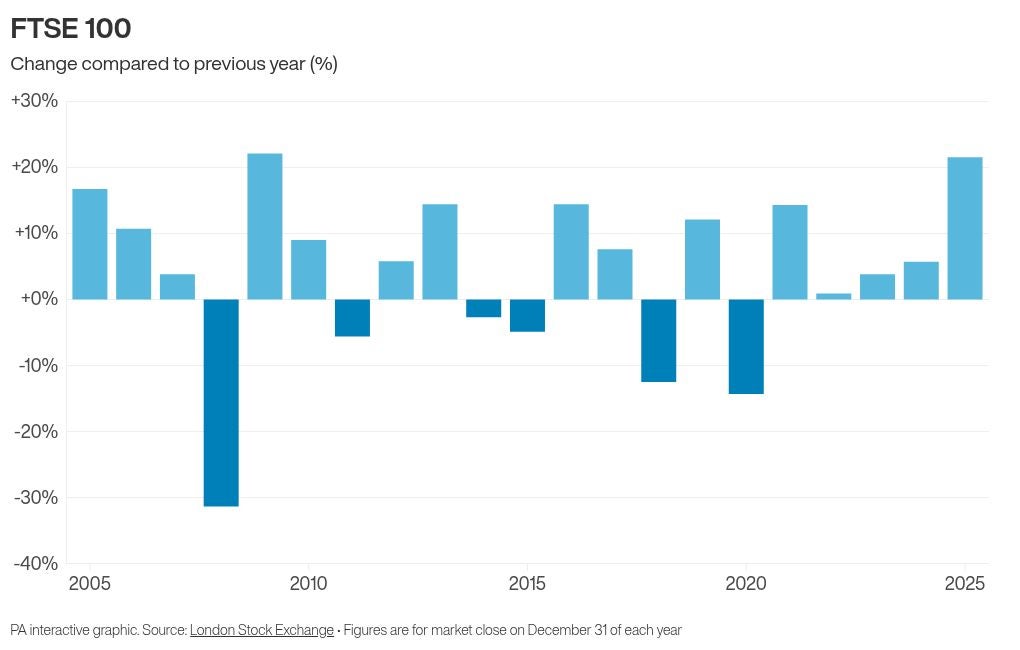

Across the course of 2025, the index of Britain’s biggest public companies rose 21.5 per cent, its best overall annual performance since the aftermath of the global financial crisis in 2009.

And the new year has started in similar fashion to hit a new all time intraday high, with traders’ return to work after the New Year’s Day bank holiday sending the index more than 1 per cent higher in quick fashion.

Despite pulling back from that level after the first hour of business, it still saw the index surpass the 10,000 milestone for the first time, with the likes of Rolls Royce and miner Fresnillo leading the charge.

London’s top tier was strengthened last year by the soaring share prices of some of its constituents, including precious metal miners, defence and financial services firms.

Investors have been attracted to the relative resilience of the stocks amid turbulence in the wider financial markets, global political uncertainty, and a lacklustre performance for the UK economy.

Dan Coatsworth, head of markets at AJ Bell, said: “This is a historic moment and already makes 2026 one of the most significant years for the blue-chip index since its launch in 1984.

“Breaking through the 10,000 level is the best new year’s present Chancellor Rachel Reeves could want.

“She has been banging the drum about the merits of investing over parking cash in the bank, and the FTSE 100’s achievements just go to show what’s possible when buying UK shares.

“It also proves to cynics that the UK market is not stuck in the mud, and that the US stock market is not the only place to make money.”

Defence firms were among stocks leading the new year charge in thin trading volumes, with engine-maker Rolls-Royce the top blue chip riser with a 3% gain, followed not far behind by sector peers Babcock International and BAE Systems, both just under 3% higher.

It continues a strong run for the defence sector, which enjoyed stellar gains in 2025 as geopolitical tensions continued to rise, with Rolls and Babcock seeing their share prices roughly doubling.

Oil firm BP lifted 2% as it continued to stride higher after revealing Meg O’Neill will become its new chief executive in April, replacing Murray Auchincloss, who stepped down last month after less than two years in the role.

The FTSE 100 closed 2025 at 9,931.38, shooting past record high levels on multiple occasions through the year and outperforming many European and US peers, including France’s Cac 40 and New York’s S&P 500.

Investors were drawn to the steady gains of FTSE-listed firms, which came in spite of weakness in the wider UK economy and political uncertainty prompting significant volatility in the global stock markets.

It was a particularly strong year for precious metal producer Fresnillo, whose share price soared by about five-fold over 2025, while gold miner Endeavor Mining’s shares jumped by nearly three-fold.

Additional reporting by PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks