British Gas profits plummet as customers switch to discounted deals

Warm weather also lessened the demand for central heating

British Gas owner Centrica has reported a near halving of its annual earnings, citing a “challenging” year influenced by unseasonably warm weather.

The profit hit was also driven by a significant shift in customer preferences towards more affordable energy deals.

The energy giant announced underlying operating profits of £814 million for the 2025 financial year, a substantial decrease from £1.55 billion recorded in 2024.

Earnings within its household energy supply business plummeted by 39 per cent to £163 million, primarily due to an £80 million impact attributed to milder temperatures, which lessened demand for central heating.

“Additionally, customers moving to fixed price products, typically at a discount to the standard variable tariff, reduced profitability compared to 2024,” Centrica said.

The group now reports that nearly a third – 32 per cent – of its customers are on fixed price tariffs, an increase from 25 per cent at the close of the previous year.

Shares in the firm fell 8 per cent as it revealed it was pausing share buybacks to prioritise its investment programme.

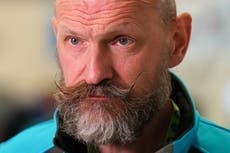

Chief executive Chris O’Shea said while the trading conditions had been difficult, the supplier had grown customers across its retail arm for the first time in more than a decade.

It saw UK and Ireland household customer numbers increase by 1 per cent to 7.96 million over the year, with 7.5 million in the UK, though this was boosted by 91,000 after taking on the customer base of failed suppliers Rebel Energy and Tomato Energy in 2025.

The gains from the two collapsed suppliers “offset a small decrease in underlying customers”, it said.

British Gas was last year overtaken by rival Octopus Energy as the UK’s largest household energy supplier.

Mr O’Shea said: “The environment has been challenging, and performance has varied across the business.

“However, we have remained disciplined, delivering strong operational performance and achieving customer growth across all our retail businesses simultaneously for the first time in over a decade.”

He added: “Pausing the buyback enables us to prioritise investment that creates lasting value for shareholders, while continuing to deliver the reliable, affordable energy that households and businesses need to power economic growth through the transition.”

The group said it plans to invest at least another £700 million in 2026 after spending in 2025 included a £1.3 billion investment for a 15 per cent stake in the new Sizewell C nuclear power plant in Suffolk.

The results come as Cornwall Insight this week forecast a 7 per cent reduction in Ofgem’s energy price cap when the next quarterly change is announced next Wednesday, with a predicted reduction of £117 to £1,641 a year for a typical dual fuel household from 1 April.

This comes after Chancellor Rachel Reeves said last November that £150 would be cut from the average household bill from April by scrapping the Energy Company Obligation scheme introduced by the Tories in government.

Centrica’s figures also showed its Rough gas storage site – a facility under the North Sea off the east coast of England – suffered lower than feared losses in 2025 and is expected to roughly break-even in 2026, despite the group previously warning it would need urgent Government help to remain open.

A recent consultation on the future of gas storage in the UK closed earlier this week and the Government is expected to make a decision in the first half of the year.

Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said: “British Gas owner Centrica’s headline numbers were a tough read as energy markets adjusted to more normalised conditions.”

On its investment programme, he said: “Results aren’t going to come cheap or quickly, though, with between £600-800 million per year set to be invested in the transition out to 2028, which could put a strain on cash flows if returns aren’t as high or quick as planned.”

Bookmark popover

Removed from bookmarks