Donald Trump isn't the only reason - or even the main one - why stock markets are booming in America and beyond

The upswing in equity markets pre-dated the arrival of President Trump - and he cannot take the credit for events in Europe, Japan, China or India, or the arrival of exciting new technologies

Is Donald Trump right to claim that since he became president there have been 84 stock market records smashed, and, indeed, that that very fact is also a stock market record? He said so in his ITV interview with Piers Morgan.

He has made such claims many times in the recent past; they, with some encouraging figures on unemployment, are the routine answer to virtually any criticism (including his record on race – “record low black unemployment” – and women – “all time low unemployment rate”).

For Mr Trump, the stock market = the economy.

Although there is no official list of these various stock market records, let’s not go so far as to dismiss the claim as necessarily “fake news”.

It’s the sort of number that looks perfectly plausible from a quick glance at the graphs. And just look at those graphs, as Mr Trump would say – those big, beautiful graphs.

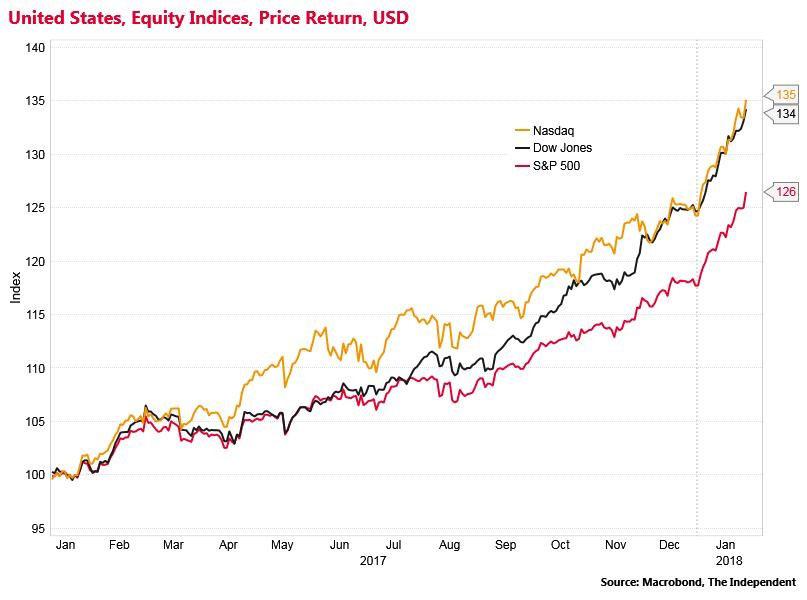

The “Trump Effect”, the “Trump Jump”, the “Trump Rally” – whatever you wish to label it, it is real enough; the S&P 500 is up 26 per cent since Inauguration Day, January 20th 2017, with the Dow Jones and Nasdaq powering ahead by 34 per cent and 35 per cent respectively. Let’s call it 30 per cent since Trump came to power, adding trillions of the value of American corporations, large and small.

So it is certainly the case that the three main US share indices have displayed impressive strength in the months since Mr Trump took over. But how much of it is down to Mr Trump and his policies?

Here are a few observations;

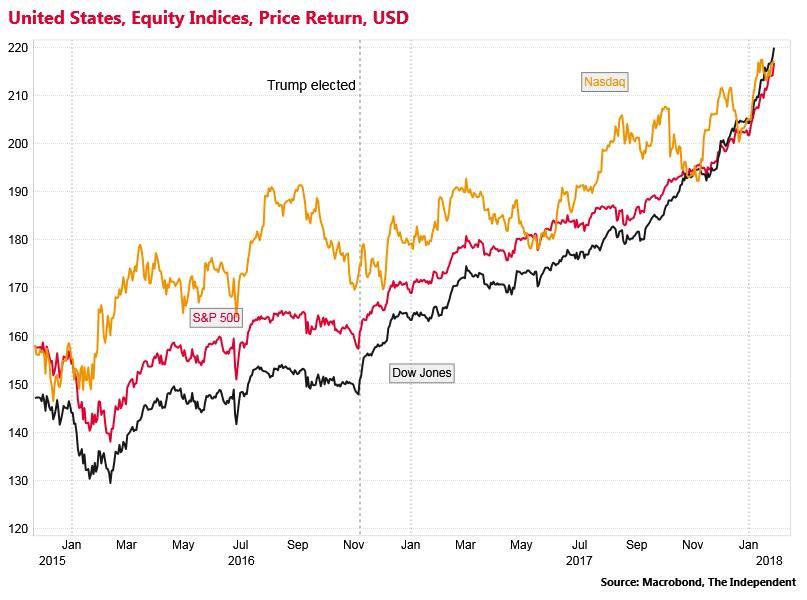

- If you look closely, you can see a definite step-change around the time of the Trump election – an unexpected event. After that, though the three indices carried on on the same strong upward trajectory they had been tracking, broadly, since the before end of the financial crisis, in about the middle of 2009 (leading indicators). There’s also a case that, after some becalming in 2015, they resumed the current bull phase in early 2016 – again, before Trump was “a thing”. Either way, Trump is not the whole story, and the pure Trump effect is relatively modest.

- Global stock markets have boomed in recent times, more or less in synch with the American ones. This speaks to the fact of globalisation: the big economic blocs tend to move together more nowadays than, say, when China was run in perfect isolation by Mao. It is most likely the case that the strong, simultaneous economic recoveries in Europe, Japan, emerging markets and North America have propelled US companies (who make lots of their money abroad) up along with others

- There have also been some secular movements. Tech stocks have shown especially big gains – which don’t have so much to do with Mr Trump’s policies, apart from his tax cuts (to be fair). But they are also a reflection of global demand for semi-conductors and technology for the cloud. The technological wonders of the next two decades – driverless cars, the end of the internal combustion engine, greener growth generally – cannot be attributed to Trump initiatives (quite the opposite in fact).

- Mr Trump’s tax cuts have certainly helped. Investors looking for big special dividends will have bought shares in anticipation of those windfall gains, and will in due course be rewarded. Some profits repatriated to America will also go to employees and to investment, as we have seen. However all of these are essentially one-off effects as accumulated profits are repatriated from offshore locations to the US. The effect will eventually wear off.

- Deregulation has helped bank shares; but there is a reason why the US authorities tightened up the rule son the likes of Goldman Sachs after the banking crash. It is easy to let Wall Street rip; but very expensive to repair damage to the economy, maybe a Depression, when it collapses.

- In the long run, as we all know, Trumpite protectionism will dent the profits of any transnational corporation looking to operate in low-cost parts of the world, and sell freely into high-price zones – maximising profits. Sooner or later that will catch up with the indices.

The Donald has been good for investors and the stock market. The Trump Effect is real – but maybe not quite as impressive as its “author” somehow claims. Economic life tends not to be as simply as the world according to Donald Trump. He can take due credit for some of the rise – which means many billions if not trillions on the overall national wealth of the US and even the world – but by no means for the lot.

Companies investing, consumers buying goods and services, and central banks and other governments pumping demand into the world economy at the same time over the past decade has been fuelling the motor of growth, long before Mr Trump got into the American driving seat.

One last point. What, I wonder, will Mr Trump say if and when stock markets start to set records on the way down? If his friends in Wall Street dump us in a Depression? He won’t be able to blame Obama or Hillary. Will he?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks