What to know about student loans controversy as graduates left worse off

The Institute for Fiscal Studies (IFS) found that those on Plan 2 loans face repaying around £3,000 more on average

The fairness of the student loans system has come under intense scrutiny this past week, as new analysis suggests budget changes will leave some graduates thousands of pounds worse off.

The Institute for Fiscal Studies (IFS) found that those on Plan 2 loans face repaying around £3,000 more on average.

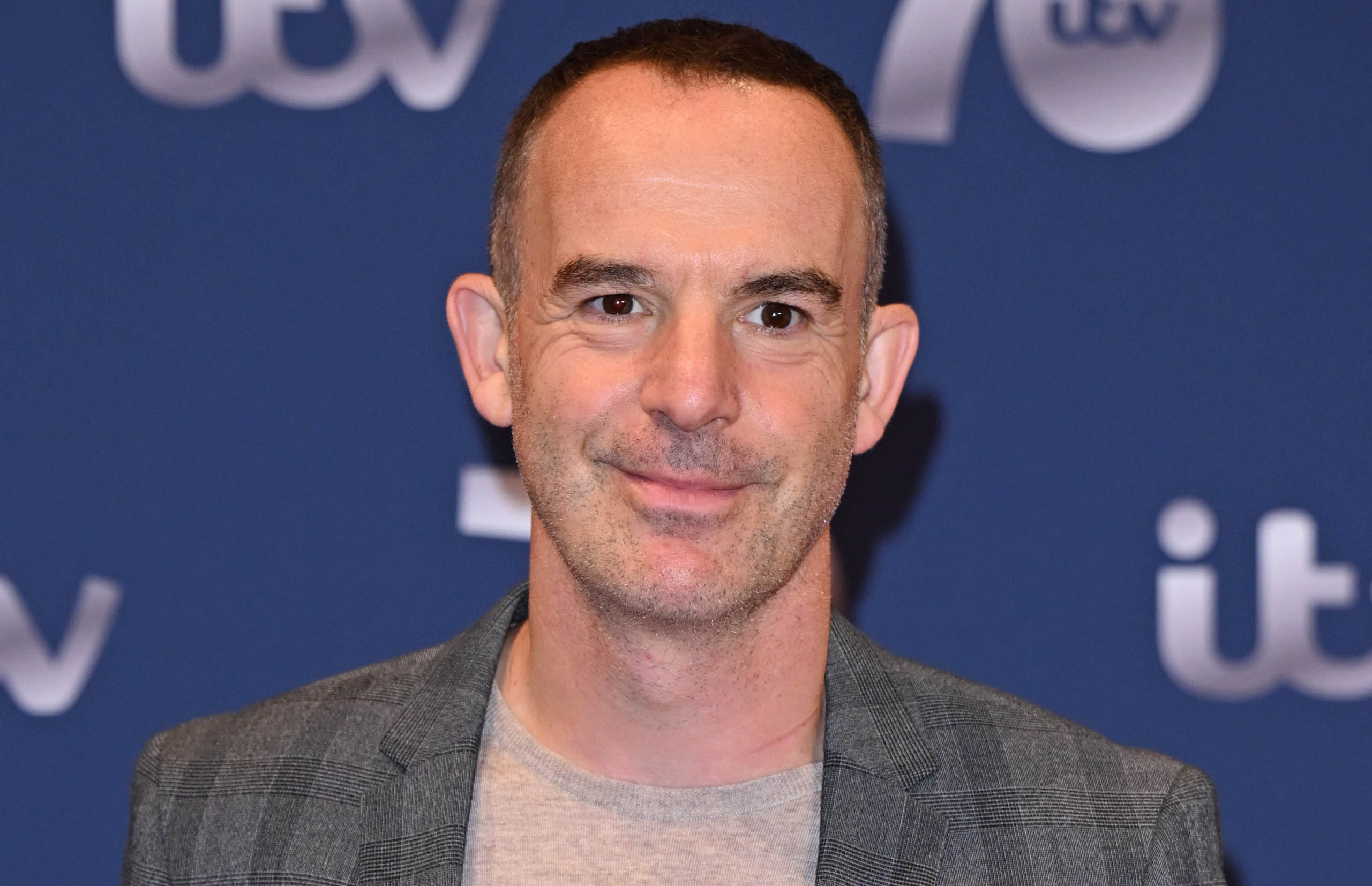

The findings drew criticism from Money Saving Expert.com founder Martin Lewis.

In response, Chancellor Rachel Reeves maintained: "I think the student loans system is fair and reasonable."

However, Health Secretary Wes Streeting later conceded that a "debate on the system is worth having", acknowledging the current difficulties faced by young graduates.

Who has a Plan 2 student loan?

Plan 2 loans began for English students who started their undergraduate courses from 2012/13 to 2022/23.

Their beginning in 2012/13 corresponds with the first year the tuition fee cap rose to £9,000.

English students who started university from 1998/99 but before the fee cap increased to £9,000 will have Plan 1 student loans, while those who started after 2022/23 have Plan 5 loans.

It’s a little bit different if you’re from Wales, Scotland or Northern Ireland.

Scottish students who started university in any of these time periods will have a Plan 4 loan, and Northern Irish ones still have Plan 1.

However, Welsh students moved from Plan 1 loans to Plan 2 in 2012/13 like English students, but have remained on Plan 2 post 2023.

We’re focusing on Plan 2 loans here.

What are the repayment terms for Plan 2 loans?

From the April after graduating, once graduates start earning above a specified repayment threshold, graduates begin repaying 9% of their income above this threshold towards their loan.

The repayment threshold is currently £28,470.

The IFS explained someone with a Plan 2 loan earning £35,000 can expect to make repayments of £49 a month, rising to £161 for someone on £50,000.

How is interest added to Plan 2 loans?

While an undergraduate is studying, interest will be added to their loan at the rate of Retail Price Index (RPI) inflation, plus 3%.

Once they graduate, interest is added at RPI inflation rate, plus up to 3% depending on how much the graduate is earning.

Currently, the income threshold for the full extra 3% interest to be added on top of inflation is £51,245.

What has changed since?

At the autumn budget, the Government announced that instead of rising with inflation each year, the repayment threshold, which is set to rise to £29,385 in April 2026, will be frozen for three years.

Essentially, this will mean more graduates will start making repayments as they are dragged over the threshold earlier than they would have been if it was rising with inflation.

Why do people think this is unfair?

The IFS said the change will mean graduates with Plan 2 loans earning above £30,416 will repay an extra £93 in 2027/28 because of the change.

In total, the IFS estimated freezes announced at the budget alone would increase the average student loan repayments made over a lifetime by around £3,000 for those who started at university in 2022, with impacts for those who started before that likely to be similar or slightly smaller.

Speaking to BBC Newsnight last week, Martin Lewis said he thought freezing the repayment threshold “is not a moral thing” to do.

He added: “People on Plan 2 loans have above-inflation loans that are linked to inflation.

“So when we’ve had high inflation, their interest rates have gone up and that has been particularly painful. And even though those rates have come down a little, well, you’ve still got a lot more now added on top of your loan, which makes it more difficult.”

When is Plan 2 student loan debt written off?

Student loans debt will be written off 30 years after the first April a graduate was due to repay.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks