Weinstein Company buyers abandon deal after additional $50 debt found

The company is expected to file for bankruptcy within the next few days

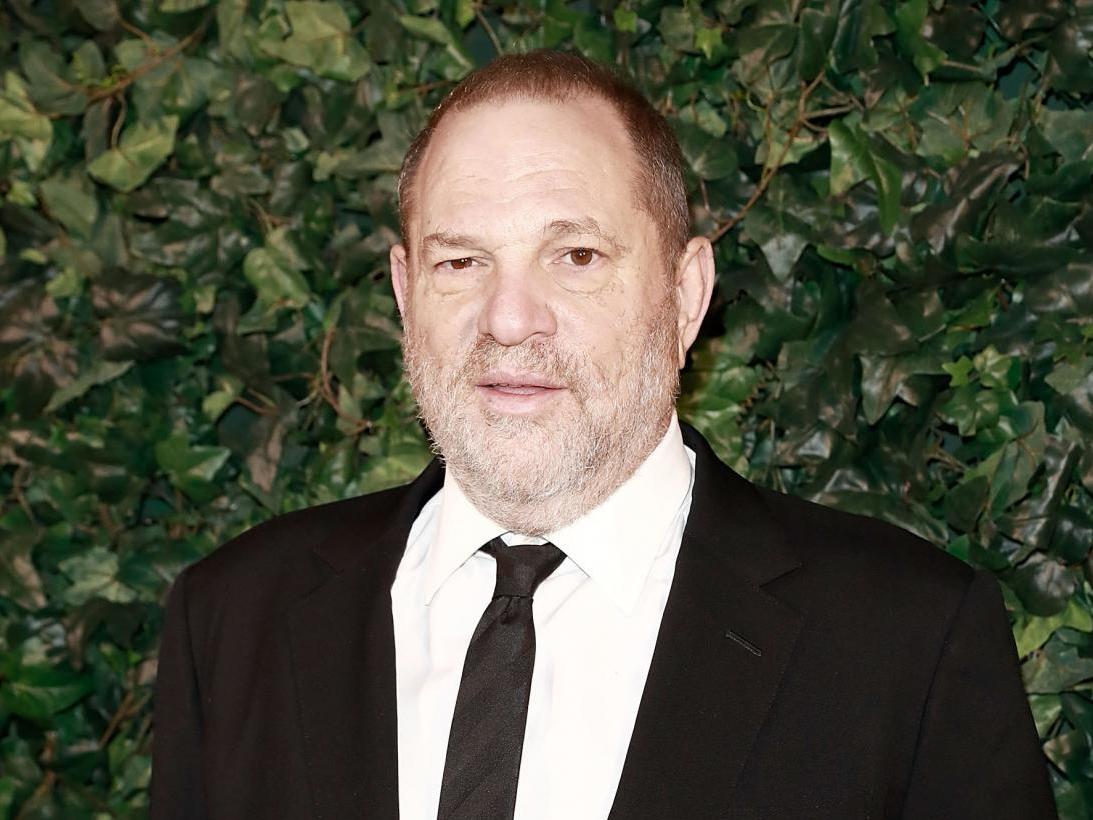

Harvey Weinstein’s production company was seemingly saved from bankruptcy at the last-minute after a consortium of buyers put forward a $500m (£363m) takeover deal.

After a week going through the details of the deal, the group — led by Maria Contreras-Sweet, who acted as head of Small Business Administration during Barack Obama’s administration — have since pulled out, citing undisclosed additional debt as the reason.

The investors initially estimated the takeover would mean taking on $225m of The Weinstein Company (TWC)’s debt. According to the LA Times, the group went over the New York company’s books with a fine-tooth comb and found an additional $50 million in undisclosed liabilities.

"All of us have worked in earnest on the transaction to purchase the assets of the Weinstein Company," Contreras-Sweet told the publication.

"However, after signing and entering into the confirmatory diligence phase, we have received disappointing information about the viability of completing this transaction.”

TWC’s board replied with their own statement, saying they had been completely transparent with their “dire financial situation” and hoped a deal could be reached.

"We regret being correct that this buyer simply had no intention of following through on its promises," the statement said.

The deal would have put Contreras-Sweet at the centre of a company awash with sexual harassment allegations against founder Harvey Weinstein. They vowed to have a female-led board of directors take over.

Analysts predict that now the deal has fallen through TWC will file for bankruptcy within the next few days. They board added they will "continue to pursue an orderly bankruptcy process to maximise the company's value.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks